Investment Banking (Maybank Kim Eng)

The investment banking business of Maybank Group, known as Maybank Kim Eng, comprises Maybank Investment Bank Berhad in Malaysia and Maybank Kim Eng Holdings Ltd in the region.

"Although we are still in the final phases of our post-merger integration programme, which is slated to conclude in mid 2013, we have already achieved a tremendous number of successes as a unified organisation. Having a key role in two of the top five IPOs globally is just one of the many examples of what we have achieved."

Tengku Dato' Zafrul

Group Chief Executive

Maybank Kim Eng

We provide a wide range of services to a large and diverse client base that includes corporations, financial institutions, governments, as well as institutional and retail investors. Our key business units are:

- Investment Banking and Advisory, which facilitates the seamless execution of transactions, and provides advice on mergers, acquisitions, restructurings, reorganisations, equity, equity-linked fund-raising and issuances and structured solutions. It also provides financial advice and policy and strategy advice, with a focus on the energy, infrastructure and utilities sectors

- Debt Markets, which advises on, arranges and distributes debt market instruments

- Equity Capital Markets, which provides services such as sales and distribution of equity, equity-linked and equityderivative products, and underwriting of Initial Public Offerings (IPOs)

- Equities/Brokerage, supported by Research, which facilitates trading of local and foreign securities via its network of dealers and remisiers, as well as via our sophisticated online trading platforms

- Equity and Commodity Solutions, which creates and offers investment products on exchanges and over-the-counter

- Futures Broking, which offers sales, execution and clearing services

Following the acquisition of Kim Eng in July 2011, Maybank Kim Eng set a common goal across all its business lines to be a Regional Financial Powerhouse by 2015. To achieve this vision and to realise the full potential of the merger, a Post-Merger Integration (PMI) programme stretching over two years was launched. As we complete our first calendar year as the combined entity of Maybank Kim Eng, we already have a number of successes to report.

In 2012, Maybank Kim Eng recorded a 44% year-on-year growth in revenue, from RM888 million in 2011 to RM1,279 million. Profit before tax for 2012 was RM345 million, a 173% increase over the preceding year. The main contributor to the increase was Investment Banking and Advisory with its strong deal flows. Our performance against industry competitors has been outstanding, being first and second on the Malaysia Bloomberg Mergers & Acquisitions (M&A) and Equity & Rights Offerings league tables respectively. In terms of our M&A business in the region, we ranked third, fourth and ninth respectively for Thailand, the Philippines and Singapore, a significant improvement from previous years.

Across the region, we have been recognised as a major player in the equities business, ranking in the top six in terms of market share in Malaysia, Singapore, Indonesia, the Philippines and Vietnam. In Thailand, we have been ranked first for the past eleven years. By tapping into the regional resources and distribution channels acquired via the acquisition of Kim Eng, we were also able to play key roles in two of the five largest IPOs across the globe in 2012, namely Felda Global Ventures Holdings' RM10.4 billion IPO and IHH Healthcare's RM6.3 billion dual-listed IPO.

All these are clear indicators that we are well on our way to building a successful investment banking and equities business in the region.

Some of the year's key deals, locally as well as globally, were:

- Felda Global Ventures Holdings IPO which raised approximately RM10.4 billion, for which we were Joint Principal Adviser, Joint Global Coordinator, Joint Bookrunner, Joint Managing Underwriter and Joint Underwriter

- IHH Healthcare IPO which raised RM6.3 billion, for which we were Joint Bookrunner for the MITI Tranche, Joint Underwriter for the Malaysia Public Offering and Singapore Underwriter for the Singapore Offering

- Maybank Placement, the largest primary placement in Malaysian corporate history with the tightest discount to close for a placement above RM3 billion

- National Bank of Abu Dhabi's Issuance of RM500.0 million Subordinated Sukuk under a RM3.0 billion Conventional and Islamic MTN Programme, for which we were Joint Lead Arranger and Joint Lead Manager (for this transaction, we were the first foreign issuer to issue Subordinated Sukuk in RM and the first bullet tier 2 structure denominated in RM)

- PLUS's Issuance of RM30.6 billion Sukuk under a combined Sukuk Programme and Government-Guaranteed Sukuk Programme with a combined limit of RM34.35 billion in nominal value (this transaction was the world's largest ever sukuk issuance)

- Tanjung Bin Energy Issuer Berhad's RM6.5 billion multi-currency, multi-product and multi-ranking holistic financing (this transaction was the first participation by international lenders for power financing in Malaysia)

Investment Banking and Advisory (IB&A)

The IB&A division facilitates the seamless origination and execution of capital market transactions, including the procurement of all necessary regulatory approvals. Based on an in-depth understanding of both client requirements and corporate milieu, we deliver holistic and innovative solutions.

2012 was a bumper year for M&A and major IPOs in Malaysia. We acted as advisors in two of the largest IPOs in the region namely, Felda Global Ventures Holdings Berhad and Astro Malaysia Holdings Berhad, which contributed to the growth trajectory in our 2012 revenue. As illustrated below, we have improved our league table position to become the No.1 M&A house in Malaysia in 2012 and won many prestigious awards, including The Asset Triple A's Best M&A House in Malaysia 2012.

M&A Malaysia League Table (1 Jan 2012 –31 Dec 2012)

| Rank | Adviser | Market Share (%) | Amount (RM mil) |

|---|---|---|---|

| 1 | Maybank IB | 36.5 | 46,628.9 |

| 2 | CIMB Investment | 30.7 | 39,231.5 |

| 3 | Goldman Sachs & Co | 26.9 | 34,470.2 |

| 4 | Morgan Stanley | 20.2 | 25,856.8 |

| 5 | Bank of America Merrill Lynch | 13.9 | 17,819.7 |

Source: Bloomberg as at 31 December 2012

In 2012, we also expanded our horizons to become a regional player in M&A and fund raising activities. Notable regional cross-border deals included the acquisition of a 65% equity interest in Esso Malaysia Berhad by Petron Oil & Gas International and the setting up of a Business Trust for Berjaya Sports Toto in Singapore. Although Malaysian deals accounted for the bulk of our revenue in 2012, we expect our new regional platform to generate an increasing number of deals going forward.

BinaFikir Sdn Bhd, the Strategic Advisory unit of Maybank Kim Eng, provides financial advisory services as well as advice on policy and strategy matters, focusing on the Energy, Infrastructure and Utility (EIU) sectors. For example, BinaFikir provides project finance advisory for the development and financing of Independent Power Producers (IPPs).

2012 was a good year for BinaFikir as the unit began to carve out a niche as a preferred adviser in the sectors which it operates. BinaFikir anticipates a further increase in private sector-led projects, Public Private Partnership (PPP) and other PPP of privatisation-linked advisory work in 2013, continuing the trend observed in 2012.

Of the transactions closed or worked on during the year, highlights included:

- Financial advisory to the winning bidder for the acquisition, financing and recommissioning of a 225MW gas-fired independent power utility located in Kulim, Kedah, which had been under receivership since 2004, culminating in the arrangement and issuance of RM650 million nominal value sukuk under a Guaranteed Sukuk Mudharabah Facility (deal was awarded in the Restructuring Deal of the Year under the Islamic Finance News Awards 2012)

- Ongoing project finance advisory to the sponsors for the development and financing of the Pagoh Education Hub PPP (being campus facilities for Pagoh Polytechnic, Universiti Tun Hussein Onn Malaysia, International Islamic Unversity Malaysia and Universiti Teknologi Malaysia) governed by multiple concession agreements which were successfully executed in November 2012

- Financial advisory and valuation services for the proposed acquisition of an independent power producer in Malaysia

- Ongoing project finance advisory to the sponsors for the development and financing of a healthcare PPP for the Government-owned clinics throughout Malaysia

Looking ahead, we expect to maintain the momentum in 2013 although many analysts are predicting a slowdown in Malaysian deals post general election. It will be a challenging year given that the debt crisis is still hanging over Europe and U.S. Nevertheless, we shall be leveraging our domestic and regional strengths to counter any eventual slowdown in Malaysia.

Debt Markets

Debt Markets consist of Debt Capital Markets (DCM), Syndicate Fixed Income (SFI), Corporate Credit & Agency (CCA) and Loans & PDS Administration (LPAD). Together, these product units work seamlessly as a value chain to deliver complete debt financing solutions for our clientele, from advisory and origination, to structuring and execution, to sales and distribution and to agency and after-market support.

We provide the full spectrum of debt products including bonds, sukuk, syndicated loans and hybrid solutions, in Ringgit and a host of foreign currencies. Our industry expertise is reflected in the variety of our transactions, where we fund all major industry segments including infrastructure, utilities, financial services and other sectors which are vital contributors to national economies.

Being client-centric, we are driven to produce customised solutions to meet our clients' unique funding requirements. This has allowed us to deliver innovative solutions and push boundaries in shaping the landscape of the Malaysian debt market. This was evident in 2012, as we continued our tradition and legacy of producing landmark bond and sukuk transactions for clients such as National Bank of Abu Dhabi, Kuala Lumpur Kepong Berhad, Johor Corporation, DanaInfra Nasional Berhad and Projek Lebuhraya Usahasama Berhad. We also developed hybrid sukuk solutions for Malaysian Airline System Berhad, a holistic multi-currency, multi-product and multi-ranking debt suite for Tanjung Bin Energy Issuer Berhad and syndicated loan transactions for 1MDB Energy Sdn Bhd, SapuraKencana Petroleum Berhad, and Petron Oil & Gas International Sdn Bhd, to name a few.

In the USD space, we successfully issued bonds for Export Import Bank of Malaysia Berhad and Malayan Banking Berhad, while in the IDR space, we completed bond issuances for PT Bank Internasional Indonesia, PT Astra Sedaya Finance, PT Indofood Sukses Makmur and PT BFI Finance Indonesia.

By embracing Maybank's "Islamic First" strategy, we continue to maintain our status as a premier sukuk house to support Malaysia as the Islamic hub of the world. We are able to harness the Maybank Islamic Banking Group's Shariah expertise, Research & Development (R&D) and network, which are integral to the success of launching Sukuk solutions.

According to the RAM Lead Managers' League Table (Conventional & Islamic), we emerged first by issuance value for 2012, an improvement from the previous year where we ranked second.

In 2012, we garnered an array of awards including:

- Malaysia Bond House of the Year, Asiamoney

- Best Bond House of the Year, Alpha Southeast Asia

- Best Sukuk Bank and Best Project Financial Advisor for Asia, Global Finance World's Best Islamic Awards

- Best Islamic Deal of the Year/Best Sovereign Sukuk, The Asset Triple A Awards for Wakala Global Sukuk Berhad's Global Sukuk Certificates

- Islamic Finance Deal of the Year, Global Finance Best Islamic Financial Institutions Awards for Wakala Global Sukuk Berhad's Global Sukuk Certificates

- Best Corporate Sukuk, The Asset Triple A Awards for Projek Lebuhraya Usahasama's Sukuk

Equity Capital Markets

The Equity Capital Markets (ECM) team provides solutions and executes equity and equity-linked transactions such as IPOs, Rights Offerings, Placements and Offerings of Convertible Securities. With a strong regional and international distribution platform, we are able to harness demand from institutional investors across the globe and successfully bring to market landmark transactions. The regional ECM team originates, participates, manages and coordinates ECM deals across the region, working hand-in-hand with the respective in-country deal teams.

We believe in fostering close advisory relationships with fund managers, governments, corporations and private companies, particularly in a dynamic and ever-changing market environment. This gives us valuable market insights on, inter alia, a wide range of financing strategies, investor behaviour, and performance of key market participants, which in turn help to ensure that our ECM deals are syndicated, marketed and distributed to the widest network of investors to enable optimal pricing of transactions.

Over the course of the year, the ECM team successfully completed a number of landmark transactions in Malaysia. The various awards won are a testament to our performance, track record and expertise in bringing companies of various sizes to market with great success for our clients. Some of the landmark transactions completed during the year include:

- Felda Global Ventures IPO, the second largest IPO globally as at pricing date, in June 2012

- IHH Healthcare IPO, the third largest IPO globally as at pricing date and the first dual listing on Bursa Malaysia and SGX, in July 2012

- IGB REIT, the largest Malaysian retail REIT by market capitalisation, in September 2012

- Astro Malaysia IPO, the third largest IPO in Southeast Asia region in 2012 as at pricing date, in October 2012

- Maybank Placement, the largest primary placement in Malaysian corporate history with the tightest discount to close for a placement above RM3 billion

The value of deals done in Malaysia has tripled over the past year, increasing from RM1.975 billion in 2011 to RM6.177 billion in 2012, which represents a market share of 19.7%. For 2012, we ranked second in the Bloomberg Underwriter Rankings Market for Malaysia Equity & Rights Offerings.

On the regional front, we completed two landmark Philippine deals in 2012:

- San Miguel Pure Foods Placement, one of the larger Philippine placements

- D&L Industries Inc IPO, the second largest Philippine IPO

Despite continued uncertainty and anticipated volatility in the global markets, Southeast Asian equity capital markets are expected to remain strong in 2013, boosted by continuing regional economic growth. We will leverage the award-winning Maybank Kim Eng regional franchise to entrench ourselves in the various domestic equity markets within the region with a view to building long-term relationships to achieve the vision of becoming a Regional Financial Powerhouse by 2015.

Retail Dealing

We are a full-fledged brokerage house providing trading, financing and research to retail investors through our wide distribution network across Asia. With the acquisition of Kim Eng, we now have expanded our presence in the region with operations in Malaysia, Singapore, Thailand, Indonesia, Philippines, Vietnam and Hong Kong. For each of these countries, we have assigned project teams that focus on strategic initiatives of expanding and leveraging regional capabilities, from products and services to branding and marketing.

We provide a comprehensive range of product offerings including dealer-assisted trading, online trading and mobile trading for both local and international exchanges. We support our valued clients with our share margin financing facilities and further enhance the trading experience with research reports encompassing wide industry and sector coverage, both locally and internationally. Some of these industries include construction, oil and gas, plantation, telecommunications, technology, media and utilities.

2012 was a successful year, with the achievement of many milestones. Some of these initiatives include successfully white labeling the Kim Eng regional online platform not only in Malaysia but also Thailand and Hong Kong. In Vietnam, a new mobile trading application was launched.

With Singapore as our business hub, we are now able to offer our regional customers, an expanded product catalogue that include Contracts for Difference (CFDs), Leveraged FX (LFX) and Fixed Income (FI). More products remain in the pipeline as we aim to bring diverse investment tools to suit the needs of various client segments.

To complement the integration of platforms, we have worked towards establishing a regional sales team to provide our clients with a high level of personalised service across markets and products, and to deliver superior customer service against the backdrop of a highly competitive landscape.

In line with Maybank Group's mission of "Humanising Financial Services", we focus on providing clients with constant interaction and trading ideas in order to build long-term relationships. We invest in our clients by providing interactive workshops to equip them with the fundamentals of trading. We held the Invest ASEAN conference in Malaysia to further educate clients on regional markets.

We have also leveraged our Kim Eng Education team in providing workshops and educational seminars for clients across the region. Likewise, our sales force is constantly provided with up-to-date training workshops to continuously improve their investing knowledge and to keep abreast with regional markets to better serve our clients. This initiative also plays an integral role in supporting regional growth as we strive to empower our clients with investing knowledge that will enable them to better manage diversified portfolios across markets and products.

We are proud of the success of these various initiatives, and are excited for several others in the pipeline. We ended the year strong with an improved market share and ranking. We are determined to imprint our brand presence across the region. Our recent awards serve as a testament of our efforts and commitment to our valued clientele:

- Best Retail Broker, Malaysia – Alpha Southeast Asia 2012

- Best Retail Broker, Thailand – Finance Asia 2012

- Best Retail Broker, Thailand – Alpha Southeast Asia 2012

- Best Retail Broker, Vietnam – Alpha Southeast Asia 2012

- Best Retail Broker, Philippines – Alpha Southeast Asia 2012

- Best Mobile Application, Singapore – Investment Trends Survey 2012

- Best Brokerage House, Malaysia – The Asset Triple A Country Awards 2012

- Best Brokerage House, Thailand – The Asset Triple A Country Awards 2012

In 2013, our aim is to further expand our business in the region to achieve our aspiration of being ASEAN's No. 1 broker.

Institutional Dealing

The institutional equities team provides equities broking and execution services to institutional clients such as pension funds, life insurance funds and mutual funds.

We engage in IPO placements, private placements and off-market block trades, and provide corporate access to clients through conferences, corporate days and non-deal roadshows.

We achieved several milestones in 2012. The high quality list of sales and marketing initiatives include seminars, corporate days, company visits, site tours and lunch presentations. In Malaysia, for the third year running, we played a critical role in organising a highly successful event, Invest Malaysia, with Bursa Malaysia to promote Malaysia's capital market. We have been involved in a number of integration initiatives such as team building and a roll-out of team and regionally-based incentive schemes. The focus was on fostering team communication and on cultivating both regional and global institutional clients.

In Malaysia, our official rankings improved further, underlined by awards from Alpha SEA and The Asset Triple A as the Best Equity House and Best Brokerage House respectively and Best Sales Person by Asiamoney among others. Our domestic institutional market share rose by 19%, helping to raise overall domestic equity market share to 7.06%, making us the No. 3 broker. This is an improvement from our ranking of No. 5 in 2011.

Regionally, we are seen as the momentum house. Our efforts to build a strong institutional sales and dealing team, together with the improvements seen in our research product have begun to bear fruit, and our clients acknowledge these. There have also been numerous new institutional accounts opened globally, credited to the cooperation between our Singapore, US, UK and Hong Kong offices. Another improvement is our broker tiering amongst clients.

The institutional equities team will continue to strive to establish its foothold in the regional market space, working towards the vision of being a Regional Financial Powerhouse by 2015.

Equity and Commodity Solutions

We serve as a catalyst for product innovation and a platform for Maybank to customise products and solutions for our retail, corporate and institutional clients. Our Equity and Commodity Solutions Division's (ECSD) business can be divided into two major markets: exchange traded products and over-the-counter markets where financial engineering techniques are used to manufacture investment instruments.

ECSD is also responsible for generating unique risk mitigation techniques to manage our clients' exposure to both commodities and equity price risk, enabling our clients to manage their capital and operations in an efficient manner.

We are one of the leading call warrant issuers in the market. In 2012, we issued a total of 83 call warrants. Some of the top call warrants last year included ASTRO-CB, FGV-CC and IHH-CM. The team has also initiated the warrants website, www.maybankwarrants.com, for the convenience of investors.

We have also launched the Equity-Linked Investment Note (ELIN) for high net worth clients. The ELIN programme has provided customers with another avenue to allocate their money into the equity asset class, in addition to the traditional cash equity market.

For commodities, we are able to provide commodity hedging on various underlying assets including crude palm oil, brent crude oil, WTI crude oil and gold.

On the regional front, ECSD Thailand too issues call warrants. In a country with 12 call warrant issuers, they are ranked in the Top 4. In 2012, they had issued 73 call warrants and put warrants. The top 3 warrants in terms of volume traded were IVL42CD (Indorama Ventures PCL), STA42PA (Sri Trang Agro- Industry PCL) and BANP42CD (Banpu PCL).

Research

Maybank Kim Eng Research is a leading independent investment research house, focused on presenting timely research materials that is ahead of the curve, ranging from macro-economic insights to an in-depth analysis of each investment opportunity, and unique ideas to institutional and retail clients. Apart from the undertaking of sectorial and companies research, our research team organises thematic conferences and workshops, and working visits to enable investors to gain a thorough understanding of the business profiles of public listed companies.

The research is organised in four broad categories: equities, fixed income, economics and politics.

Futures Broking

We launched our Futures product in end 2012, which offers Crude Palm Oil Futures, KLCI Futures and all contracts listed on Bursa Malaysia Derivatives Berhad. With presence in Malaysia, Singapore and Hong Kong, we offer sales, execution and clearing services to institutional, corporate and retail clients. Our trading portal named Futures2u, offers convenient online trading that enables our clients to access markets from virtually anywhere. In 2013, we plan to roll out foreign futures products to provide access to major exchanges worldwide.

54.3%

In 2012, Corporate Banking revenue leapt 54.3% to a record figure of RM2.3 billion. Performance was boosted by strong growth in Term Loans (+25.4%).

Corporate Banking (CB)

The Corporate Banking division assesses and underwrites credit proposals to support clients' business requirements. We structure high quality loans by bundling relevant products from other product partners, including Transaction Banking, Global Markets, Investment Banking and Maybank Islamic Berhad.

We also handle specialised lending such as cross-border project financing, syndications and bridging loans.

Our clientele comprises of government (including government-linked companies), Malaysian corporates and multi-national companies.

In 2012, Corporate Banking revenue leapt 54.3% to a record figure of RM2.3 billion. The performance was boosted by strong growth in Term Loans (+25.4%).

Asset quality and productivity both improved during the year, and we also embarked on credit process enhancements which have significantly expedited our response to clients' needs – thereby boosting loans growth with higher acceptance of our proposed products and solutions.

With our improved asset quality, we managed to grow loans by 11.5%. We also maintained deposit level with Current Accounts and Fixed Deposits growing at 29.4% and 10.5% respectively.

Transaction Banking (TB)

Launch of Regional Cash Management Services in Singapore (Nov 2012)

Transaction Banking is built on four lines of business: Cash Management, Trade & Supply Chain Financing, Financial Institutions and Securities Services. Securities Services was formed in November 2012 by merging Maybank Custody Services and Maybank Trustees Berhad – a move that enhances our capabilities in our key regional markets.

In 2012, we saw a marked improvement in our Cash Management market share in both transaction volume and transaction value which increased from 42.9% and 33.6% in 2011 to 48.5% and 39.4% in 2012 respectively. Trade Finance also maintained its healthy position with a market share of 26.5% in December 2012.

Meanwhile, we expanded our Transaction Banking business regionally into Singapore, Indonesia, the Philippines and Greater China. We also improved our Trade & Supply Chain Financing and Securities Services business models, aligning us with our regional peers.

On the technology front, to enhance our clients' liquidity management and transaction execution, we rolled out three regional electronic channels: Regional Cash Management – Maybank2E, Trade & Supply Chain Financing – TradeConnex, and Securities Services – eCustody.

Global Markets (GM)

Global Markets caters to the treasury needs of our clients. Our products and services include Foreign Exchange, Money Market, Fixed Income Markets, Derivatives and structured products. We play a key role to advance Maybank's regional presence whilst ensuring a holistic and integrated trading strategy across the Group's treasury centres world-wide.

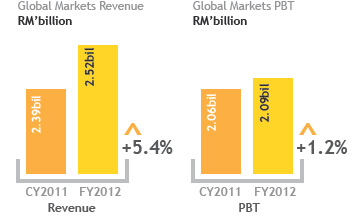

The Malaysian operations of Global Markets saw an improvement in revenue and PBT by 10.7% and 16.5% to RM1.7 billion and RM1.5 billion respectively on the back of a softer economic environment.

Regionally, Global Markets contributed a total revenue and Profit before Tax of RM2.5 billion and RM2.1 billion respectively. Securities portfolio gained 9.63% to RM92.8 billion with 31.3% coming from foreign securities as at December 2012.

During the year, we put in place a seamless Global Treasury Risk Management System encompassing front and middle office in Singapore, Jakarta, Labuan, Manila, Hong Kong, Shanghai, London and New York. We now have clearly defined regional operating models and a platform that allows us to monitor the risks that we are taking at all times, consistent with the risk appetite statement that we have set out for ourselves.

Maybank Asset Management (Maybank AM)

Maybank AM is the Maybank Group's fund management arm, and is fast becoming an integrated regional asset manager offering investors access to multi-investment solutions and regional investment capabilities.

Consolidating the Group's asset management businesses has resulted in a strong presence in the key Southeast Asian markets of Malaysia, Singapore, Thailand and the Philippines. Moving forward, Maybank AM has the potential to make significant acquisitions in the ASEAN region.

Maybank AM aims to offer a unique proposition which lies in the expertise of our on-the-ground teams. A common regional platform integrates the teams who operate from their respective countries to research and deepen market capabilities.

During the year, Maybank AM Malaysia's Assets Under Management (AUM) charted a remarkable 74.5% growth from RM4.7 billion at the beginning of the year to RM8.3 billion as at 31 December 2012. This high double digit growth was the result of continuous marketing efforts and improved regional investment capabilities through the exchange of investment know-how across the Maybank AM group of companies.

2012 Domestic AND Regional Awards

Alpha Southeast Asia Awards

- Best Custody Solution of the Year

- Best IPO Deal Of The Year In Southeast Asia & Best Deal Of The Year In Southeast Asia for Minority Shareholders (Felda Global Ventures Holdings IPO)

- Best Dual-Listed IPO Of the Year in Southeast Asia (IHH Healthcare Bhd IPO)

- Best Equity Deal Of The Year In Southeast Asia (IHH Healthcare Bhd IPO)

- Best Mid Cap Deal Of The Year In Southeast Asia (Gas Malaysia Bhd IPO)

- Best REIT Deal Of The Year In Southeast Asia (IGB REIT)

- Most Innovative Deal Of The Year In Southeast Asia (IGB REIT)

- Best Project Financing Deal Of The Year In Southeast Asia (DanaInfra Nasional's Islamic Commercial Papers & IMTN)

- Best Islamic Finance Deal Of The Year In Southeast Asia (IMTN Programme +PLUS Guaranteed Sukuk)

- Best Bond House, Malaysia

- Best Equity House, Malaysia

- Best Retail Broker, Malaysia

- Best Institutional Broker, Singapore

- Best Retail Broker, Philippines

- Best Retail Broker, Thailand

- Best Retail Broker, Vietnam

The Asset Triple A Award

- Best Deal (Joint bookrunner for the MITI tranche on IHH Healthcare IPO)

- Islamic Deal of the Year/ Best Sovereign Sukuk (Wakala Global Sukuk Bhd)

- Best Islamic Deal, Malaysia (Wakala Global Sukuk Bhd)

- Best Islamic Equity (Bumi Armada IPO)

- Best Corporate Sukuk (Projek Lebuhraya Usahasama Sukuk)

- Best Islamic Restructuring Deal (Pengurusan Aset Air Bhd)

- Best M&A House, Malaysia

- Best Brokerage House, Malaysia

- Best Brokerage House, Thailand

Global Finance Magazine

- Islamic Finance Deal of the Year (Wakala Global Sukuk Bhd)

IFR Asia Awards

- Malaysia Capital Markets Deal of the Year (IHH Healthcare Bhd Malaysia and Singapore IPO)

Asiamoney Awards

- Most Improved Brokerage Over the Last 12 months, Malaysia

- Best Salesperson in Malaysia

Islamic Finance News Awards

- Malaysia Deal of the Year (PLUS IMTN Programme and Guaranteed Sukuk Programme)

- Most Innovative Deal of the Year (Malaysian Airline System Bhd Perpetual Junior Sukuk)

- Project Finance Deal of the Year (Boustead Naval Shipyard Syndicated Trade Facilities )

- IPO Deal of the Year (Felda Global Ventures )

- IPO Restructuring Deal of the Year (N.U.R Power Sukuk)

KLIFF Islamic Finance Awards 2012

- Most Outstanding Islamic Investment Bank

Financeasia Awards

- Best Broker, Philippines

Outlook

Our unique proposition is to capitalise on our full presence in ASEAN countries to exert our leadership position in this region and capture cross border ASEAN business whilst providing coverage to ASEAN corporates with regional aspiration. With our regional client coverage team fully intertwined and collaborating with our regional product specialists, we are fully committed to support our regional clients' cross border business.

Besides that our key focus for 2013 is on regional growth and strengthening our regional position with our target to derive at least 50% of GB revenue from outside of Malaysia. To achieve this, we will continue to invest in our people and technology to create a regional operating model and platform that best serves the needs of our clients.

Over the next 12 months, we will strengthen our capabilities in pursuit of our 2015 aspiration. We will complete our integration with Kim Eng and complete implementation of regional organisation for Maybank Kim Eng businesses.

Trade Finance, Cash Management and Custody Services' regional electronic platforms will be launched in the remaining key home markets as well as in Greater China. Other priorities include a strategic expansion into growth markets, with focus on increasing our market share of corporate loans and deposits regionally.

Key Regional Deals For Financial Year 2012

Indonesia

- PT Astra Sedaya Finance

-

-

IDR 5 trillion

- Bond Programme

Joint Bookrunner & Joint Mandated Lead Arranger

- February 2012

-

Indonesia

- PT Indofood Sukses Makmur Tbk

-

-

IDR 2 trillion

- Bond Programme

Joint Lead Underwriter

- May 2012

-

Indonesia

- PT BFI Finance Indonesia Tbk

-

-

IDR 575 billion

- Bond Programme

Joint Lead Underwriter

- June 2012

-

Indonesia

-

-

- PT Rukun Raharja Tbk

-

-

-

IDR 230 billion

- Rights Issue II

Financial Advisor

- June 2012

-

Singapore

-

-

- Pre1 Investment Pte Ltd

-

-

-

SGD 246 million

- Term Loan

Mandated Lead Arranger

- April 2012

-

Singapore

-

- MS Commercial Pte Ltd/ Ophir - Rochor

-

-

SGD 5 billion

- Syndicated Term

Loan

Mandated Lead Arranger

- April 2012

-

Singapore

-

- Marina Bay Sands Pte Ltd

-

-

SGD 5.1 billion

- Syndicated Term

Loan / Revolving

Credit Facilities

Global Coordinator & Mandated Lead Arranger

- June 2012

-

Singapore

-

- Hao Yuan Investment Pte Ltd

-

-

SGD 261.34 million

- Club Term Loan

Mandated Lead Arranger

- August 2012

-

Singapore

-

-

- EL Development (Sengkang) Pte Ltd

-

-

-

SGD 348.2 million

- Club Term Loan

Mandated Lead Arranger

- September 2012

-

Indonesia

- YTL Powerseraya

-

-

SGD 535 million

- Club Term Loan /

Revolving Credit

Facilities

Bookrunner & Arranger

- September 2012

-

Singapore

- OUB Centre Ltd

-

-

SGD 165 million

- Syndicated Term

Loan / Revolving

Credit Facilities

Mandated Lead Arranger & Bookrunner

- October 2012

-

Singapore

- Thai Beverage PLC

-

-

SGD 500 million

- Syndicated Term

Loan

Coordinating Bank, Mandated Lead Arranger & Bookrunner

- December 2012

-

Philippines

-

-

- South Luzon Tollway Corporation

-

-

-

PHP 22.5 billion

- 10-Year Syndicated

Term Loan

Mandated Lead Arranger

- March & April 2012

-

Philippines

-

-

- Petron Oil & Gas International Sdn Bhd (part of San Miguel Group)

-

-

-

RM 1.77 billion

- Acquisition of 65% equity interest in Esso Malaysia Berhad and 100% equity interest in Exxonmobil Borneo Sdn Bhd and Exxonmobil Malaysia Sdn Bhd from ExxonMobil International Holdings Inc Adviser

- March 2012

-

Philippines

-

-

- Petron Oil & Gas International Sdn Bhd (part of San Miguel Group)

-

-

-

RM 339.26 million

- Unconditional mandatory take-over offer by Maybank IB, on behalf of POGI, to acquire all the remaining ordinary shares of RM0.50 each in EMB not already owned by POGI for cash offer price of RM3.59 for each Offer Share Adviser

- March 2012

-

Philippines

- Petron Oil & Gas International Sdn Bhd (part of San Miguel Group)

-

-

RM 720 million

- Bridging Loan

Joint Mandated Lead Arranger & Bookrunner

- April 2012

-

Philippines

- Exxon Mobile Borneo (part of San Miguel Group)

-

-

RM 1.8 billion

- Working Capital

Joint Mandated Lead Arranger & Bookrunner

- May 2012

-

Philippines

- Petron Oil & Gas International Sdn Bhd (part of San Miguel Group)

-

-

USD 480 million

- 5-year Syndicated

Term Loan

Mandated Lead Arranger

- November 2012

-

Philippines

- Travellers International (Resorts World Manila)

-

-

USD 250 million

- 7-year Bilateral

Term Loan

Lender

- November 2012

-

Hong Kong

- Genting Hong Kong Limited

-

-

USD 600 million

- Term Loan and

Revolving Credit

Facility

Joint Coordinator, Joint Mandated Lead, Arranger & Joint Underwriter

- September 2012

-

Hong Kong

- Genting Hong Kong Limited

-

-

USD 300 million

- Term Loan and

Revolving Credit

Facility

Joint Mandated Lead Arranger

- October 2012

-

Malaysia

- Maxis Berhad

-

-

RM 2.45 billion

- Unrated Islamic

Medium Term Notes

Programme

Joint Lead Manager

- February 2012

-

Malaysia

- Tanjung Bin Energy

-

-

RM 6.6 billion

- Project Financing

Joint Principal Adviser, Joint Lead Arranger, Joint Lead Manager, Mandated Lead Arranger & Financier

- March 2012

-

Malaysia

- Malaysia Airports Holdings Bhd

-

-

RM 616 million

- Private Placement

Principal Adviser & Joint Placement Agent

- March 2012

-

Malaysia

- Sapura Kencana

-

-

RM 2.05 billion

- Syndicated Term Loan

Joint Mandated Lead Arranger

- May 2012

-

Malaysia

- Sapura Kencana

-

-

RM 11.2 billion

- Merger & Listing

Joint Principal Adviser

- May 2012

-

Malaysia

- Johor Corporation

-

-

RM 3 billion

- Islamic Medium

Term Notes

Programme

Joint Lead Arranger, Joint Bookrunner, Joint Lead Manager & Syariah Adviser

- June 2012

-

Malaysia

- Felda Global Ventures Holding Bhd

-

-

RM 10.4 billion

- IPO

Joint Principal Adviser, Joint Global Coordinator, Joint Bookrunner, Joint Managing Underwriter & Joint Underwriter

- June 2012

-

Malaysia

- Malaysian Airlines System Bhd

-

-

RM 2.5 billion

- Perpetual Junior

Sukuk Programme

Sole Principal Adviser, Sole Lead Arranger & Sole Lead Manager

- June 2012

-

Malaysia

- Export Import Bank of Malaysia Berhad

-

-

USD 1.5 billion

- Multi Currency

Medium Term Notes

Programme

Joint Principal Adviser, Joint Lead Arranger, Joint Lead Manager, Joint Bookrunner & Listing Agent

- June 2012

-

Malaysia

- DRB-Hicom

-

-

RM 3.02 billion

- Merger & Acquisition

Joint Principal Adviser & Lead Arranger

- June 2012

-

Malaysia

- Genting Capital Berhad

-

-

RM 2 billion

- Medium Term Notes

Programme

Joint Principal Adviser, Joint Lead Arranger, Joint Bookrunner & Joint Lead Manager

- June 2012

-

Malaysia

- Gas Malaysia Berhad

-

-

RM 734.5 million

- IPO

Principal Adviser, Sole Bookrunner & Joint Managing Underwriter

- June 2012

-

Malaysia

- DanaInfra Nasiaonal Berhad

-

-

RM 8 billion

- Sukuk

Joint Lead Arranger & Joint Lead Manager

- July 2012

-

Malaysia

- Hong Leong Bank Berhad

-

-

RM 1.05 billion

- Subordinated Notes

Joint Principal Adviser, Joint Lead Arranger & Joint Lead Manager

- July 2012

-

Malaysia

- SME Bank

-

-

RM 3 billion

- Sukuk

Joint Principal Adviser, Joint Lead Arranger, Joint Lead Manager & Joint Bookrunner

- July 2012

-

Malaysia

- Government of Malaysia

-

-

RM 2.6 billion

- Sukuk

Joint Bookrunner & Joint Lead Manager

- July 2012

-

Malaysia

- IHH Healthcare Berhad

-

-

RM 6.3 billion

- IPO

Joint Bookrunner for MITI Tranche, Joint Underwriter for the Malaysia Public Offering & Singapore Underwriter for Singapore Offering

- July 2012

-

Malaysia

- Celcom Transmission (M) Sdn Bhd

-

-

RM 5 billion

- Sukuk

Joint Lead Manager

- August 2012

-

Malaysia

- Tanjung Bin Power Sdn Bhd

-

-

RM 4.5 billion

- Islamic Medium

Term Notes

Programme

Sole Principal Adviser, Lead Arranger & Joint Lead Manager

- August 2012

-

Malaysia

- Malakoff Corporation Bhd

-

-

RM 1.8 billion

- Sukuk Refinancing

Sole Principal Adviser, Lead Arranger, Lead Manager & Joint Buyback Agent

- September 2012

-

Malaysia

- PTPTN

-

-

RM 3.5 billion

- Sukuk

Joint Lead Arranger, Joint Lead Manager & Joint Syariah Adviser

- September 2012

-

Malaysia

- IGB REIT

-

-

RM 4.25 billion

- IPO of REIT

Joint Bookrunner & Joint Underwriter

- September 2012

-

Malaysia

- Kuala Lumpur Kepong Berhad

-

-

RM 1 billion

- Multi Currency

Islamic Medium

Term Notes

Programme

Joint Principal Adviser, Joint Lead Arranger, Joint Lead Manager & Joint Bookrunner

- September 2012

-

Malaysia

- Astro Malaysia Holdings Berhad

-

-

RM 15.6 billion

- IPO

Joint Principal Adviser, Joint Global Coordinator, Joint Bookrunner & Joint Managing Underwriter

- October 2012

-

Malaysia

- Putrajaya Holdings Sdn Bhd

-

-

RM 3 billion

- Sukuk

Joint Principal Adviser, Joint Lead Arranger, Joint Lead Manager

- October 2012

-

Malaysia

- Malayan Banking Berhad

-

-

RM 3.7 billion

- Private Placement

Principal Adviser & Joint Placement Agent

- October 2012

-

Malaysia

- Imtiaz Sukuk Berhad

-

-

RM 1 billion

- Islamic Medium

Term Notes

Programme

Joint Principal Adviser, Joint Lead Arranger, Joint Lead Manager, Joint Bookrunner & Joint Syariah Adviser

- November 2012

-