Global Banking

In 2012, we have gained visibility regionally reflected by the increasing domestic and regional awards recognising our business capabilities. Client Coverage continues to provide a single point of contact that allows consistent relationship experience for our clients throughout the region. With the opening of our Laos branch in November 2012, we are now the first regional bank to have physical presence in all ten ASEAN member nations. We believe our strong presence will enable us to support our regional clients as they expand their business operations across Southeast Asia.

In 2012, we also welcomed a new addition to the Global Banking (GB) family, Maybank Asset Management Group, which focuses on growing our asset and fund management business across the region. GB now has complete suite of product capabilities that will give us the flexibility to provide holistic solutions to our corporate clients regionally.

"Within a short span of 2.5 years our global banking business has delivered major milestones, both locally and regionally. Positive client feedback on how we have supported them is a testament to our effective regional coverage model with local expertise, complemented by sector and industry experience, offering global solutions to raise our clients to greater heights. This is Maybank Global Banking."

Datuk Abdul Farid Alias

Deputy President and

Head, Global Banking

Highlights

- In 2012, GB recorded revenue of RM5.3 billion.

- PBT increased by 44.7% year-on-year to RM3.8 billion.

- Loans grew by 11.5% year-on-year.

- Asset quality improved significantly with net impaired loans registered at 0.52% from 2.00% in the previous year.

Overview

- In 2012, we activated our Client Coverage teams for the region, leveraging on local expertise coupled with regional reach and complemented by sector/industry experience to customise solutions for our regional clients.

- Investment Banking's successful integration with Kim Eng has positioned the new brand entity, Maybank Kim Eng, to tap the increasing opportunities in the region, whilst strengthening its visibility as a leading regional investment bank and broking house.

- To better manage the Bank's global risk and support its cross border portfolio growth, Global Markets deployed the Global Treasury Risk Management System (GTRMS) in major countries and all Treasury Centres, such as Singapore, the Philippines, Hong Kong, London and New York.

- Corporate Banking enhanced its end-to-end credit lending origination processes and accelerated its speed-to-market to provide better turnaround time and hence improve service levels.

- Transaction Banking has introduced its web-based regional cash management platform that is also integrated to a web-based regional Trade Finance and Securities Services platform to better support our clients' business expansion across the region.

- Asset Management is fast becoming a regional one-stop centre, with presence in Malaysia, Singapore and Thailand, serving both conventional and Islamic funds as well as private equity investors.

Financial Performance

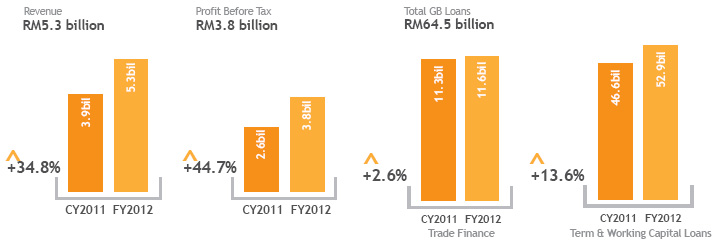

- GB reported a 34.8% growth in revenue to RM5.3 billion in 2012 compared to RM3.9 billion in 2011. This was mainly due to higher net interest income ("NII") of RM2.6 billion compared to RM2.1 billion in the previous year. We continued to register strong loan growth notwithstanding the continued pressure in margins.

- GB's PBT grew to an impressive RM3.8 billion for 2012, 44.7% higher than the previous year (2011: RM2.6 billion)

- Total GB Loans stood at RM64.5 billion as at 31 December 2012, 11.5% higher than 2011. This is largely driven by higher term loans outstanding of RM34.8 billion compared to the previous year of RM27.6 billion.

- We registered loans growth of 11.5% year-on-year and trade finance registered a notable market share of 25.3% as at November 2012.

- Our current accounts and fixed deposits grew by 29.4% and 10.5% respectively.

- Asset quality improved year-on-year, reflecting our sound risk practices and much improved debt recovery.

+34.8%

Reported a growth in revenue to RM5.3 billion in 2012 compared to RM3.9 billion in 2011.

Non-Financial Performance

- GB has won 53 key awards in 2012 from renowned publications, amongst them EuroMoney, AsiaMoney, FinanceAsia, Alpha SEA Awards and the Asset Triple A Awards.

- Out of these awards, 15 of them are regional awards including Alpha SEA's Best Retail Broker in the Philippines, Thailand and Vietnam, Best Deal of the Year in SEA, Best Islamic Trade Finance Solution of the Year in SEA, Best REIT Deal of the Year in SEA, Best Project Financing Deal of the Year in SEA and Best Custody Solution of the Year in SEA.

Strategic Thrust & Initiatives

Our transformation journey to be the leading wholesale bank in Southeast Asia started with the successful implementation of our GB operating model in Head Office with Client Coverage at the heart of our client relationship.

The foundation was laid when we launched Maybank Kim Eng and rolled out the GB regional front office governance structure across all countries with regional specialists supporting the local business heads to strengthen our regional offerings.

In 2012, the key focus was on strengthening our regional capabilities through further streamlining of our business lines and rolling out regional business platform and operating models. Some of the key achievements and milestones:

- Maybank Asset Management Group was established to focus on regional asset management business.

- Consolidated several business lines within Transaction Banking to form Trade & Supply Chain Financing as well as Securities Services offering both Custody & Trustee services under one brand.

- Deployed the Global Treasury Risk Management System across nine countries to better manage our trading risk globally.

- Launched web-based Regional Trade Finance front-end platform in all countries.

- Launched web-based Regional Cash Management Services in Singapore and Malaysia.

Client Coverage

Collaborating with both GB product partners and different business sectors across the Maybank Group, Client Coverage offers clients a full suite of tailored products and solutions.

With their diverse investment banking, corporate banking and capital market background, the Client Coverage team builds long-term relationships based on constant engagement with our clients and a holistic understanding of their needs. Personalised management is also reinforced by a single, product-neutral point of contact that enables us to provide consistency of service region wide.

This has resulted in a tremendous growth in cross-border deals in 2012 and a further expansion of our client base.