International Operations

Beyond Malaysia, our commercial banking business operates in 16 countries, 10 in ASEAN and the rest in strategic markets including Greater China, the Middle East, the United Kingdom and the United States. Although our international business started off with wholesale banking, we now have a thriving retail banking presence in our home markets of Singapore and Indonesia, as well as in the growth markets of the Philippines and Cambodia.

Highlights

- PBT grew by an impressive 39.1% for the financial year ended 31 December 2012 year-on-year.

- Our continued international expansion resulted in overseas profit contribution growing to 30.2% (up 45.4% year-on-year) of Group profit.

- Loans and deposits grew 12.1% and 13.6% respectively from December 2011.

- Our Beijing and Laos branches commenced business operations.

- Our Cambodia Operations were locally incorporated (now known as Maybank Cambodia Plc.) and our Myanmar Representative Office was reactivated.

- We added two new branches each in the Philippines and Cambodia and also 53 branches in Indonesia.

Overview

Financial Performance

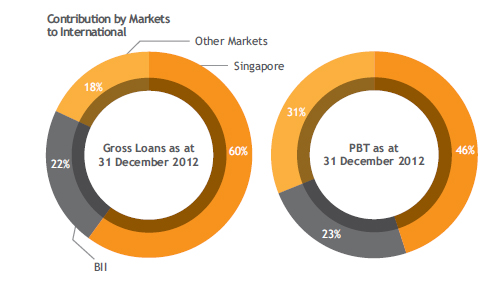

Revenue from the Groupís international banking operations grew 15.5% to RM5.2 billion. This was underpinned by a 16.5% rise in its net fund-based income as well as a 13.7% rise in fee-based income. Gross loans for the Groupís international operations collectively grew 12.1% since Dec 2011, and now make up 36.1% of total Group gross loans. Revenue from this sector makes up 31.2% of total Group revenue whilst PBT makes up 29.0%.

Achievements

We achieved a significant milestone in our expansion this year as we completed our footprint in all ten ASEAN countries. Our subsidiary PT Bank Internasional Indonesia Tbk (BII) now has 404 branches to serve Indonesian customers, and we also have 54 branches in the Philippines. Our twelfth branch opened in Cambodia in 2012, as well as our first in Laos. We launched our Beijing branch and reactivated our representative office in Myanmar last year, and internet banking services in Cambodia and Papua New Guinea are boosting brand awareness and improving visibility amongst clients there.

In 2012, we deployed various technological platforms across our international operations. A regional Cash Management System in Singapore standardises our cash management capabilities across our Overseas Units. We launched a webbased Trade Finance platform in Singapore, Indonesia, Hong Kong and Shanghai, and we plan to extend it to the Philippines and Brunei next year. Meanwhile, our new Global Treasury Risk Management System in New York, London, Shanghai, the Philippines, Hong Kong and Labuan enhances our risk governance.

Outlook

We expect the global economy to expand by 3.4% in 2013, although the growth will likely be as uneven as it was last year. Chinaís economy should enter a new phase of moderate growth as domestic economic rebalancing and reforms take place. ASEAN economies are expected to climb by 5.5% on average, benefitting from the stabilisation of global markets, a pick-up in world trade, available macroeconomic policy space for monetary accommodation, and fiscal stimulus to support domestic demand. The predominant influences on the 2013 outlook will be policy and political developments in the major economies, namely American fiscal policy, Eurozone crisis management, and Chinese policies on economic transition after the leadership change.

With our presence in all ASEAN countries established this year, we will now focus on expanding our ASEAN footprint and brand visibility. We will also extend our reach into Greater China and South Asia, offering both retail and wholesale banking whilst leveraging on the strong Maybank brand.

Our International Presence

In Addition To Our Branches And Subsidiaries, We Have A 20% Equity Interest In Mcb Bank Ltd. (Mcb) In Pakistan, And 20% Equity Interest In An Binh Joint Stock Commercial Bank (Abb) In Vietnam.

| Where We Started | Where We Are Now | |

|---|---|---|

| 1960 | SINGAPORE | Qualifying Full Bank with full commercial banking setup of 22 branches |

| 1960 | BRUNEI | Branches in Bandar Seri Begawan, Seria & Gadong |

| 1962 | UNITED KINGDOM | Branch in London |

| 1962 | HONG KONG | Branch in Hong Kong |

| 1984 | USA | Branch in New York |

| 1993 | CHINA | Branches in Shanghai and Beijing |

| 1993 | CAMBODIA | 12 branches in Phnom Penh, Siem Reap Sihanoukville Battambang & Kg Cham |

| 1993 | UZBEKISTAN | Uzbek Leasing International (35% stake) |

| 1994 | PAPUA NEW GUINEA | Branches in Port Moresby and Lae |

| 1995 | INDONESIA | 2 subsidiaries

|

| 1996 | VIETNAM |

|

| 1997 | PHILIPPINES | Locally incorporated as Maybank Philippines Inc. with 55 branches |

| 2003 | BAHRAIN | Branch in Manama |

| 2008 | PAKISTAN | MCB Bank Ltd (20% stake) |

| 2012 | MYANMAR | Representative office in Yangon (re-activated) |

| 2012 | LAOS | Branch in Vientiane |