Maybank Greater CHINA

Overview

Maybank Greater China was established in October 2010. The Hong Kong and Shanghai branches and the Beijing representative office worked on an integrated basis with a high level of cross-border cooperation.

2012 saw the expansion of services in the Chinese capital with the launch of a new Beijing branch, which complements the two existing branches in providing wholesale banking solutions to commercial and corporate customers with a business presence in China. We relocated our Hong Kong branch to Citic Tower in December 2012.

Financial Performance

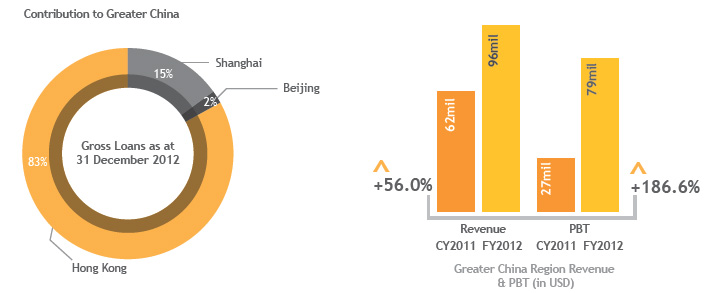

- Maybank Greater China's PBT increased more than 186.6% to USD78.6 million in FY2012. Hong Kong and Shanghai contributed 80.3% and 19.7% respectively.

- Net interest income also rose by 33.3% to USD55.3 million, attributed mostly to interest on corporate term loans.

- With the participation of the Beijing branch, the Greater China team has strengthened its loans book to USD2.8 billion, an increase of 15.8% from the previous year.

Achievements

Our focus last year on building infrastructure, capabilities and client base in Greater China proved fruitful. In addition to providing cross-border Renminbi trade settlement in Shanghai, as of June 2012 we became the first Ringgit Malaysia (RM) account provider for corporate clients outside of Malaysia. We deployed TradeConnex, a web-based regional trade finance platform and channel with straight-through processing capabilities, and as a result, our trade finance revenue shot up by 59% in 2012.

We also launched the China National Advanced Payment System (CNAPs), a Renminbi payment system used throughout China. This enables the Shanghai branch to accept Renminbi deposits.

Outlook

Predicted GDP growth of 7% to 8% in 2013 suggests that the operating environment for Chinese banks will remain stable. Overall credit growth is expected to be around 15% in 2013. The government's stimulus projects and a shift from investment-driven to consumption-led growth will influence the economic performance.

We will continue to focus on growing our client base by tapping our core clients across the ASEAN-China region and strengthening our cross-border product services. We also intend to expand in Greater China to fulfil our mission to become a leading offshore universal wholesale bank with a strong China capability.