Other Overseas Units

Overview

Maybank has established itself in other regions that we have identified as Opportunistic Markets. These operations include two branches in Papua New Guinea (PNG), three branches in Brunei, treasury centres in London and New York, a reactivated representative office in Myanmar, a branch in Bahrain, and an Islamic banking arm in Jakarta and a subsidiary in Labuan.

Financial Performance

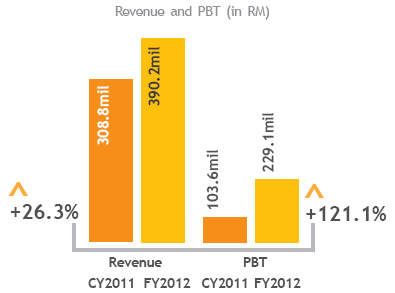

- For the year under review, Opportunistic Markets have contributed PBT of RM229.1 million, growing more than 121.1% from the previous year.

- Net interest income and non-fund based income, meanwhile, grew by 29.0% and 20.0% to RM281.7 million and RM108.5 million respectively, boosted mainly by treasury and corporate lending from these overseas units.

- Consistent with the improved profitability, the Opportunistic Markets loans position rose to RM8.7 billion, 9.1% up on the previous financial year.

Achievements

We continued to streamline systems and processes in line with Head Office initiatives resulting in both increased revenue and reduced funding costs. In 2012, internet banking was rolled out in PNG and the Global Treasury Risk Management System was rolled out in London and New York.

In collaboration with private banks in Myanmar, we introduced Maybank Money Express services and established correspondent banking relationships, thus marking our early steps in the country's banking sector. We also sponsored a range of seminars and forums in Myanmar.

Outlook

Looking ahead, the medium to long-term economic outlook for the Opportunistic Markets is encouraging. In 2013, we aim to boost brand awareness and enhance our services through such initiatives as rolling out an ATM network in PNG and setting up an offshore branch in Labuan. The latter will put us in a better position to capitalise on the growth of Labuan as a leading regional offshore financial centre.

Asociates

MCB Bank

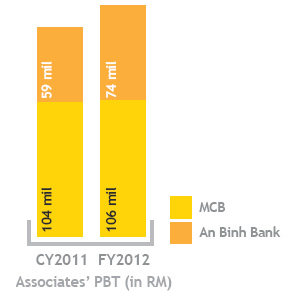

MCB Bank is Pakistan's largest bank in terms of market capitalisation, and last year its PBT edged up 3.7% to PKR 32.5 billion. Despite the country's challenging economic situation and a dip in net interest margin, our associate achieved a growth of 5.4% in net loans, while customer deposits advanced 11.0% to PKR536.2 billion.

An Binh Bank (ABB)

For FY2012, our Vietnamese associate ABB recorded a significant rise in PBT of 24.1% to VND497.1 billion, despite the challenging local economic conditions. Growth in noninterest income and lower loan loss provisioning were the leading contributors to the year's success.

Lower lending rates stimulated gross loans, which were up by 15.6% from the last financial year. Customer deposits rose by 31.2%, largely driven by monies received from the retail sector. Maybank's continued cooperation with ABB enhanced the services and products offered by both banks, which support each other as regional players in the industry.