Community Financial Services

Community Financial Services (CFS) – the retail banking arm of the Bank – serves individual, Retail SME (RSME) and Business Banking (BB) customers. Our vision is to become Malaysia's Undisputed No. 1 Retail Financial Services Provider by 2015.

Customers are served holistically under a One-Stop Shop concept that leverages on a shared distribution model. This enables us to serve the needs of the community via more than 400 branches and 4,700 Self Service Terminals (SSTs) across Malaysia.

"In FY2012, CFS once again made good progress in our core mission of serving the community. By understanding their needs and supporting all sectors, we are able to make a real contribution to community development. This, coupled with our commitment to growing responsibly, has seen us sustain our growth momentum over the years"

Datuk Lim Hong Tat

Deputy President and

Head, Community Financial Services

Highlights

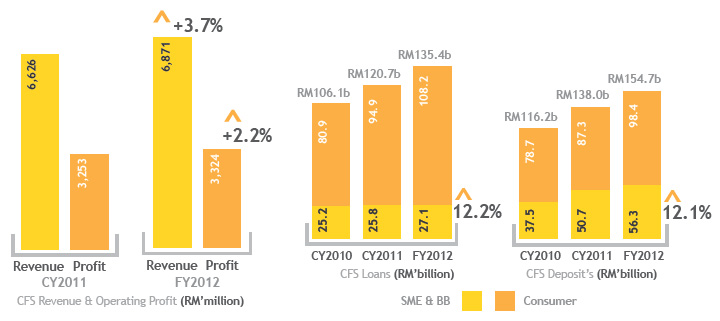

- In FY2012, profit before tax hit RM3,024 million on the back of RM6,871 million revenue.

- Growth in CFS loans and deposits stood at 12.2% and 12.1% respectively, with both outpacing industry growth.

- Consumer/household loans market share further improved to 17.0% from 16.4% while consumer deposits edged to 18.3%.

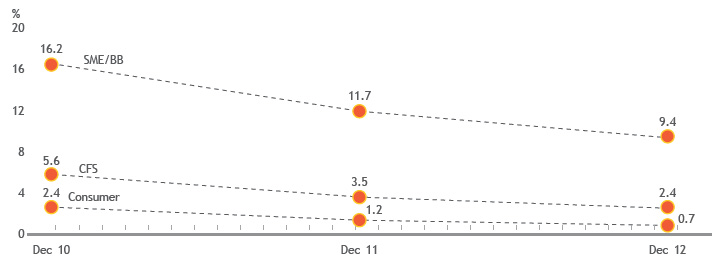

- Credit asset quality continued to improve as the Gross Impaired Loan (GIL) ratio was brought down to 2.4% with the consumer segment reducing from 1.2% to 0.7%.

Overview

| RM billion | CY2011 | FY2012 | Growth |

|---|---|---|---|

CFS Gross Loans

|

120.7 42.1 27.7 19.8 5.3 25.8 4.5 21.4 |

135.4 48.5 31.2 23.2 5.4 27.1 4.9 22.2 |

12.2% 15.2% 12.9% 17.2% 1.0% 5.0% 10.3% 3.9% |

CFS Deposit

|

138.0 87.3 50.7 |

154.7 98.4 56.3 |

12.1% 12.7% 11.1% |

CFS Gross Impaired Loans Ratio

|

3.5% 1.2% 11.7% 10.6% 11.9% |

2.4% 0.7% 9.4% 5.7% 10.2% |

-1.1% -0.5% -2.3% -4.9% -1.7% |

CFS Gross Impaired Loan Ratio

# Dec'10 figures refers to NPL Ratio

Key Milestones In FY2012

- We operationalised our customer-centric and segment-led focus strategy that resulted in High NetWorth (HNW) and Affluent Banking segments achieving customer and total financial asset (TFA) growth of 11.9% and 19.2% respectively.

- We implemented a new RSME business model, a transformational change that allows us to accelerate growth and better serve our SME customers in a more cost effective way.

- We rolled out 29 MaybankOne kiosks – a new concept of branchless banking.

- We reengineered and centralised our retail credit functions through the Centralised Processing Centre - Originator Processor (CPC-OP) to improve efficiency and turnaround time.

- We embarked on various service transformation initiatives to further enhance our service standards. Our customer engagement survey scores and Average Waiting Time (AWT) at the branches have improved.

- Regionally, our cards, payments and wealth management businesses continued to make good progress towards a more integrated business model.

Overall Performance

2012 was a challenging year for CFS. To address the household debt level, Bank Negara Malaysia (BNM) implemented responsible lending guidelines on top of its 70% loan-to-value (LTV) ratio on third property purchases and more stringent guidelines on credit cards. These measures contributed to the further softening of loans growth for the industry as a whole, and especially in the consumer segment. In the face of these challenges, CFS remained resilient, reporting a profit before tax of RM3.0 billion on a revenue of RM6.9 billion, and continued to be the largest contributor to the Group's revenue.

Against this challenging background, that also saw fiercely competitive pricing, CFS still managed to achieve a creditable 12% increase in both loans and deposits, a rise in market share across various products, and an improvement in asset quality. Retail business growth was mainly driven by mortgages (+15.2%), automobile loans (+12.9%) and retail finance (+17.2%) while consumer deposits were up by 12.7%.

Meanwhile, our GIL ratio improved, reducing to 2.4% in December 2012. The consumer segment, in particular, has trended down from a high NPL ratio of 6.6% in 2007 to just 0.7% in 2012 in terms of GIL ratio. This is mainly due to efforts in reinforcing our credit asset quality framework as well as pursuing proactive prevention and recovery activities, ensuring quality loan origination, incorporating a risk-based approach by leveraging on risk tools, and strengthening the capabilities of our risk management oversight function.

Mortgage Financing

- Mortgage financing grew 15.2% to RM48.5 billion and climbed to a No. 2 market position.

- Market share advanced to 13.4% from 13.2% last year.

- Shop house loans rose 31.6% to a balance outstanding of RM7.5 billion.

- GIL Ratio declined further to 1.1%.

Mortgage financing registered strong double-digit growth for the third year running. This reflected our continued focus on rebalancing our portfolio to accelerate loans growth. We have adopted a marketing strategy that is based on customer segmentation. In order to increase our margins, we have increased product cross-selling, adopted risk-based pricing as well as rebalanced our portfolio by targeting the right properties and segments to finance. We also continued to pursue proactive retention programmes to reduce attrition and drive refinancing.

During the year, we extended our overseas mortgage financing to Melbourne and Singapore to meet the needs of our HNW and Private Banking customers. Our new emphasis on secondary loan acquisitions has further enhanced our asset quality.

During the year, we successfully reengineered our mortgage approval process by launching the CPC-OP project, a centralised hub that improves retail credit efficiency and TAT by streamlining the processing and underwriting of mortgages. As a result, it now takes less than three days to get a standard loan approved.

Automobile Financing

- Loans climbed 12.9% to RM31.2 billion.

- Hire Purchase market share rose from 19.4% to 20.5%.

- GIL ratio fell to 0.4%, the lowest in the industry.

- We remained the No. 1 Islamic Auto Financier, and the sole provider of Islamic floor stocking and block discounting.

+12.9%

AUTOMOBILE FINANCING

We remained the No. 1 Islamic Auto

Financier, and the sole provider of

Islamic floor stocking and block

discounting.

Our HP business has now outpaced industry growth for five consecutive years, which has resulted in a corresponding growth in our market share. To achieve this, we have been highly selective in our financing. We have rebalanced our HP portfolio, and now offer integrated product bundling for end-customers based on broad customer segments and lifestyles to improve overall portfolio margins.

Our ability to outgrow the competition has also been spurred by attractive marketing and promotional campaigns as well as a comprehensive dealer management programme that has strengthened our relationship with top dealers.

During the year, we introduced new products, My First Car Loan for the younger generation - students, graduates and young professionals, and Car4Cash refinancing plans as well as auto collaboration with our SME and business banking customers.

Cards Business

- We were No. 1 in customer cards, with 1.5 million cardholders and a 18.4% market share.

- We were No. 1 in billings, growing 15.5% year-on-year to RM27.3 billion, with a 26.1% market share.

- We were No. 1 in merchant sales, growing 16.0% year-on-year to RM32.4 billion, with a 32.8% market share.

- Our GIL ratio reduced to 1.1%.

Despite subdued growth in credit cards due to stricter lending guidelines by BNM, Maybank continued to outpace industry growth in cardholder numbers, billings and merchant sales.

During the year, we launched a range of innovative products such as the Maybankard Manchester United Visa Debit Card, the Maybank Debit Prepaid Card, the Maybank Mastercard Prepaid University Smart Card, and the Visa Infinite Ikhwan Card. We also enhanced the value proposition of our Petronas Card.

At the same time, we continued to drive spending via numerous marketing campaigns as well as by focusing on new customers to generate additional billings and receivables.

Regionally, we have established the Centre of Excellence team to foster collaboration and leverage best-in-class business and technology practices. The Centre of Excellence drives cross-border initiatives and facilitates the roll out of regional marketing programmes that involve cross-border privileges, especially in the leisure and travel segment. In addition, the team also looks into process and policy enhancements to realise cost savings regionally.

1.5million

CARDHOLDERS

We were No. 1 in customer cards, with 1.5 million

cardholders and an 18.4% market share.

Retail Financing

- Our retail financing portfolio went up by 17.2% to RM23.2 billion.

- Unit trust loan financing jumped 18.1%, growing to a balance outstanding of RM21.9 billion, contributing 99% of total retail financing growth.

- In 2012, we were the No. 1 Unit Trust Financier in Malaysia with a 60.2% market share.

Various campaigns were held during the year to promote our unit trust loan financing as well as leveraging on our MaybankOne Kiosks by promoting our ASB Flexi product.

We successfully launched Skim Amanah Rakyat 1Malaysia (SARA1M) in line with the government's aspiration to elevate household investment. We also launched a special loan package to partly finance students' education fees/expenses with selected universities, as part of the Bank's commitment to humanise financial services.

Funding And Deposits

- We achieved double digit deposit growth, spearheaded by consumer growth at 12.7% and RSME and BB growth at 11.1%.

- Consumer deposits CASA market share stood at 23.6% with growth of 13.1% during the year.

- We outpaced industry growth in all key consumer deposit portfolios.

CFS deposits registered strong double digit growth, with low-cost CASA deposits increasing market share during the year. We were selective in growing high-cost deposits by being more disciplined in applying customer based pricing.

Deposits growth was driven by our continued process reengineering efforts and strategies to reach our Mass and HNW customer segments. During the year, we launched two new deposit accounts; Personal Saver and Private Banking Account and a series of thematic and tactical campaigns which saw strong take up by all three segments i.e. Consumer, SME and BB. We also stepped up our Payroll acquisition initiatives, focusing on the SME and BB segments.

High Networth And Affluent Banking Segment (Hab)

- We achieved customer growth of 17.7% for HNW and 10.8% for the Affluent Banking segments.

- Total Financial Assets (TFA) increased 22.7% and 15.6% for the HNW and Affluent Banking segments respectively.

- Total Assets under Management (AUM) achieved year-onyear growth of 50.1% to RM8.0 billion.

- Our cross-selling ratio continued to rise even with an increasing customer base.

In line with our customer-centric and segment focused model, we rolled out numerous transformation initiatives to acquire and migrate customers to higher segments. Our segment-based approach allows us to better understand the needs of the different segments, enabling us to better serve our customers.

This year, we expanded the number of Private Banking Centres & Lounges from 44 to 56 to cater to the rapidly growing number of clients. We will continue to invest in building capabilities as part of our ongoing efforts to enhance the depth and breadth of our products and services and to develop relationship bankers as trusted advisors to clients.

The year saw our investment business introducing 13 new funds. We also launched campaigns to drive investment volume, such as Amanah Hartanah Bumiputera which is exclusive to Maybank.

Internet And Mobile Banking

- In 2012, we remained the leading internet banking provider with a 48% market share and over 2.15 million active users, despite intense competition from existing and new internet banking players.

- We were the first bank to introduce comprehensive mobile banking services, gaining an 80% market share.

- Average monthly transactions hit eight million with a value in excess of RM6.6 billion.

We continued to maintain leadership in the virtual banking space, having half of the nation's online banking market. In 2012, M2U active users grew by a significant 17.0% to 2.15 million active users. Meanwhile, M2U business customers grew by 33.7% with the roll-out of services to support BB and SME customers.

The year also saw the number of mobile banking users shooting up considerably by 135.2% with the introduction of Maybank2u apps for iPad, iPhone, Android and Windows Phones.

We launched a variaty of innovative products. Our latest M2U product is a personal financial management tool enabling customers to monitor their total spending and manage their savings and investments via a one-stop portal.

Payments

- We recorded a fee-based income of RM342.6 million.

- Maybank Money Express (MME) was extended to 13 countries, with 8,243 touch points.

In 2012, we continued to dominate the payments business in Malaysia while also driving expansion regionally in the areas of payment services, remittances and foreign currency notes. We expanded MME to four more countries - Oman, Bangladesh, Papua New Guinea and Myanmar.

Numerous initiatives and marketing campaigns were undertaken focusing on product innovation and tactical promotions to generate new revenue drivers. In collaboration with Digi, we launched DigiSend Money, an over-the-counter service for Malaysians and foreigners to remit cash overseas.

We also became the first bank in Malaysia to offer a Silver Investment Account which was well received by our customers as it gave them an additional avenue to diversify their portfolio. Meanwhile, our Gold Investment Account can now be transacted via M2U, making it easier for customers to invest in gold.

Bancassurance

- We strengthened our No. 1 position in Banca Life, with a 28.4% market share.

- New premiums (AFYP) grew by 29.0% to more than RM1 billion.

In partnership with Etiqa, we launched a Transformation Programme in 2012 to bolster our market leadership in Bancassurance. In order to cater to the needs of the Affluent and HNW segments, we successfully launched two new Retirement products, Smart and Golden Retirement, as well as two innovative Single Premium Investment-linked plans - Dragon9 and AUSpicious10. These products met the needs of our customers and registered high take-up rates.

Business Banking

- BB loans outstanding stood at RM22.2 billion.

- We continued to lead the market in business enterprise loans with a market share of 19.0%.

- The GIL ratio further reduced to 10.2%.

- We successfully implemented our Go-To-Market strategy, focusing on high growth and high potential sectors.

During the year, we rolled out Distributor and Supplier Financing to drive business growth, and continued to collaborate with other business units within the bank to cross-sell products in the BB segment. We also extended our "Hunter-Farmer" model nationwide. This aims to provide excellent customer service through an efficient delivery system so as to support our asset acquisition momentum.

Meanwhile, we targeted the right market segments and sharpened our industry focus, at the same time avoiding high risk areas, and enhanced our fraud detection capabilities. This led to better quality loans booked and as a result, we expect GIL ratio to further reduce moving forward.

Retail Sme

- RSME transformation initiatives were fully implemented nationwide.

- Loans outstanding grew by 10.3%, rising to RM4.9 billion.

- The GIL ratio reduced to 5.7%.

In order to drive rsme business and develop a more customerfriendly and cost-effective business model, we rolled out our RSME Target Operating Model (TOM) to all eight regions in 2012.

The TOM includes changes to the business model for RSME which strengthened the sales team and embedded it into key branches to leverage on our wide distribution network and accelerate growth. It also centralised support functions, boosted straight-through processing and simplified the product structure. We also introduced a new RSME Scorecard and related risk-assessment tools to strengthen credit evaluation.

Looking ahead, we will continue to focus on asset acquisition, balancing both secured and unsecured portfolios to increase margins.

Channel Management

- We have an unmatched distribution footprint of more than 400 branches and 4,700 SSTs with a market share of 19% and 24% respectively.

- We enhanced customer experience and satisfaction by refreshing more than 100 branches and opened eight new branches during the year.

- We extended our reach to mass customers via 29 MaybankOne kiosks nationwide.

- We formed strategic partnerships with POS Malaysia involving 350 post offices nationwide.

In 2012, we continued with our branch transformation programme with the refurbishment of our branches with the new "Hip and Cool" branch design. Coupled with improved customer service, the physical transformation has increased customer traffic and broadened our appeal to our customers. Meanwhile, our strategic partnership with POS Malaysia has enabled us to reach out to a larger base of rural communities without the cost of setting up new offices.

During the year, we launched a new way of serving mass market segment customers via a branchless banking initiative called MaybankOne. MaybankOne kiosks are located close to the community and provide the convenience of extended banking hours seven days a week. They also offer PersonalSaver, a mass-market 7-in-1 product bundle that targets both urban and rural customers.

Under the Service Transformation Programme, we continued to roll out initiatives to improve customer service at all touch points. We launched initiatives to reduce the average waiting time (AWT) at our branches by managing customer queues at peak and non-peak hours, to equip branch frontliners with the desired product knowledge required to serve our customers better as well as to improve first contact resolution (FCR). More than 90% of our branches now exceed the required standards when servicing customers.

Awards

2013

- Visa Malaysia Bank Awards – Maybank emerged winner in

seven categories:

- Bank of the Year Award

- Largest Visa Card Issuer (Issuing category)

- Largest Payment Volume or Billings (Issuing category)

- Largest Payment Volume – Maybank Petronas (Visa Credit co-Brand)

- Highest Payment Volume or Billings – Maybank Manchester United (Visa Debit co-Brand)

- Largest Payment Volume (Islamic credit card)

- Largest Acquirer (Acquiring category)

- Euromoney Private Banking and Wealth Management Survey

2013 – Maybank emerged winner in eight categories:

- Best Private Banking Services Overall

- Relationship Management

- Privacy and Security

- Range of Investment Products

- Net-worth Specific Services – Super Affluent (US$500,000 – US$1 million)

- Net-worth Specific Services – High Net Worth I (US$1 million – US$10 million)

- Net-worth Specific Services - High Net Worth II (US$10 million – US$30 million)

- Net-worth Specific Services – Ultra High Net Worth (Greater than US$30 million)

2012

- Reader's Digest Year 2012

- Gold Award for Card Issuer

- Gold Award for Bank

- Visa Card Awards 2012 - Maybankard Manchester United

- Gold - Promotion Marketing Awards Malaysia 2012 (Best Product Launch)

- Gold - Promotion Marketing Awards Malaysia 2012 (Best Sponsorship Marketing Tie-In)

- Silver - Promotion Marketing Awards ASIA 2012 (Best Sponsorship Marketing Tie-In)

- Gold - Marketing Events Awards ASIA 2012 (Best Sponsorship Activation)

- Winner of GNS Partner Awards

- Outstanding Acquisition Programme (M2C)

- Outstanding Digital Marketing Campaign (M2C Launch)

- Mastercard Hall of Fame Events

- Winner for Best Acquisition Campaign (Maybank Malaysia)

- Finalist for Best Activation Campaign (Maybank Malaysia)

- inOvation Malaysia Awards 2012: M2U mobile Payment app

- Maybank2u.com: Financial Insights Innovation Awards (FIIA) "Innovation in Social Marketing"

- NEF Awani ICT Awards 2011: Maybank2u.com Favourite Online Banking under the "People's Choice"

- Banking & Payments Asia (BPA) Trailblazer Awards 2012: Process Excellence in Customer Centricity

- Banking & Payments Asia (BPA) Trailblazer Awards 2012: Product Excellence in Payment Innovation

- SMI Association of Malaysia: Sahabat Negara SME

- Radar Global SME Bank Reputation Awards 2012: Gold Medal Award

Outlook

In 2012, CFS proved resilient in a challenging market, with the growth of most of our retail loan portfolios outpacing the industry average, underpinned by prudent and vigilant financing practices.

In 2013, we will maintain an aggressive but controlled approach to achieving our growth targets. Amid increasing competition, margins continue to come under pressure. To improve margins, we will therefore focus on a portfolio rebalancing strategy, apply Risk Based Pricing and increase cross-selling and share of wallet. With our strong sales engine and continued focus on productivity improvements from our sales staff, frontline service staff and back office support personnel, we are optimistic in our outlook for 2013.

Other key priorities this year will include cost management, customer service enhancements and stepping-up our strategic transformation initiatives aimed at boosting long-term sustainability. At the same time, we will be expanding our cross border regional initiatives to realise greater synergies as a regional bank.