Enterprise Transformation Services

Enterprise Transformation Services (ETS) is the foundational layer in the Group, providing best in-class services to our internal customers and providing differentiated platforms for external customers. Our aspiration is to consistently provide upward momentum as the Group's enabler to achieve a sustainable competitive advantage via Technology, Operations and Service Excellence.

Geoff Stecyk

Head of Enterprise Transformation Services

Information Technology (IT)

Information Technology continues to focus on building regional capabilities that assist the Maybank Group to achieve its regional aspirations. Maybank's IT Transformation Programme (ITTP) continues to gain momentum as we proceed to the third year of our five-year plan to achieve a flexible, integrated, competitive advantage via information technology to enable businesses to achieve their aspirations. The new platform involves system, process and control changes that will unify business units across sectors and throughout the countries in which Maybank operates.

In FY2012, IT continued its focus on technology that supports regionalisation. We launched internet banking (M2U) in Cambodia, Vietnam and Papua New Guinea. Our new Regional Treasury System is a robust, flexible and intuitive system built on a platform of virtualised servers and consolidated databases. We introduced a mobile trading system comprised of Amanah Saham Bumiputera and iCustody, replacing an older custodian back-end system.

TradeConnex is Maybank's new regional trade finance platform which provides fast and sophisticated service delivery. It is web-enabled to ensure accessibility, mobility and convenience for clients and it puts market updates, e-applications, and correspondence with the Bank's team of trade finance specialists at clients' fingertips. In FY2012, TradeConnex was implemented in phases in Cambodia, Hong Kong, Shanghai, the Philippines, Singapore and Indonesia.

We are also part of the Maybank One Solution, designed to develop more convenient banking tools and methods. We have devised an integrated 7-in-1 financial product bundled with fast approval and activation in ten minutes. A 3-in-1 smart terminal incorporates an e-signature pad, PIN pad and MyKad reader which scans the customer's identification details directly into the system.

IT Transformation Programme (ITP)

ITTP is a Group transformation initiative kicked off in July 2010 which provides technology advancements to support regionalisation of the businesses.

Business and IT are collaborating to develop our Essential Advantage: Three core capabilities giving Maybank the ability to surpass its competitors and provide superior customer experience:

- Multi-channel Sales and Service - Consistency of products and services across all our channels

- Integrated Customer Analytics - Convenience of powerful real-time analysis of what our customers want

- Agile Product Manufacturing - Customisation of product development and delivery

In FY2012, ITTP focused on implementing two strategic initiatives i.e. the Regional Branch Solutions (RBS), previously known as Branch Front End and the Regional Cash Management System (RCMS).

RBS offers customers service consistency, increased processing efficiency, mobility, and standardised teller platforms throughout the region. Customers will experience paperless transactions, effective customer identification, and no home branch restrictions – in short, reduced waiting and counter processing times. RBS successfully went live in selected pilot branches in FY2012; nationwide deployment is slated for Q2 2013.

RCMS offers corporate clients a tool for liquidity control, with Maybank2E as the gateway to the single-transaction banking platform across ASEAN and Greater China. This platform combines ease of use with comprehensive real-time data. It is a cross-border system with secured access to liquidity positions, management of payments and receivables, and a choice of six languages. Its mobile banking facility offers convenient access to account information and authorisation of payment instructions through mobile devices. The application is available for Apple and Android devices as well as mobile browsers. RCMS was successfully rolled out in Singapore and Malaysia, and the Phase 3 roll out to the Philippines, Indonesia and Greater China is in progress.

The Regional Enterprise Data Warehouse (REDW) project kicked off in November 2012. This system offers a single source for the Bank's data, improving reporting speed and accuracy.

Two foundational pieces were rolled out in 2012, namely Infrastructure Server Virtualisation and the Electronic Document Management System (EDMS). Server virtualisation and consolidation as well as network upgrades were completed to ensure reliability and hardware optimisation.

The EDMS Common Platform manages the Bank's critical documents effectively. EDMS forms the foundation for a paperless organisation. It standardises the content management system across Maybank's regional and functional units, which will facilitate straight-through processing and enforce consistent business rules and process improvements. EDMS roll-out started in July 2012.

Recognition

Our IT initiatives did not go unnoticed. Maybank received two awards at the Annual ICT Leadership Awards 2012, hosted by the National ICT Leadership Association of Malaysia (PIKOM). Mr. Tan Kok Meng won the 2012 CIO of the Year Award, and our integrated financial analytics ‘Clarity, Aligning Strategy and Unifying Project Information' earned the ICT Organisation of the Year Award.

Operations

Operations is the Back Office processing unit for backroom branch operations, self service terminals operations support, the collateral management system, credit administration, inward and outward funds transfers, and the trade processing centre.

The Bank continues to surpass industry benchmarks in ATM and CDM operations. Once again, the Bank achieved 98.74% ATM uptime in 2012, an improvement from 98.6% in 2011, whilst our CDMs enjoyed 96.25% uptime compared to 95.46% the prior year. Our ATM team rolled out the Dynamic Currency Converter for MasterCards, enabling customers to view transactions in their home currencies when using our ATMs.

In 2012, Operations Transformation focused on two areas: Credit Administration and the Trade Operations Centre (TOC). The Credit Administration transformation goal was increased efficiency: process simplification, reduced duplication, better turnaround time, straight-through processing rate at all points, and lower error rates for the sales team and solicitors.

TOC has been growing regionally since 2011, becoming the processing centre for trading applications for our overseas units in the Philippines, Brunei, Vietnam, Shanghai, and Cambodia. By centralising the administrative function at TOC, where certified personnel handle the document-checking, our Trade Finance Centres can focus on driving sales and revenue for the Bank.

Group Collateral Management System (GCMS) is a centralised application which provides the framework for meeting Basel II Risk Compliance guidelines – specific operational and monitoring requirements for credit risk mitigation techniques. GCMS is an automatic system for the revaluation of specific eligible collaterals, and it houses the single source of collateral data for regulatory reporting.

In 2012, we rolled out the Inward Clearing Processing System, which replaced the existing Online Capturing System (OLCS) and Image Positive Pay System (IPPS) with a single web-based application. This new tool enables branch staff to complete the verification process on the spot, reducing customers' waiting time.

Recognition

Operations achieved the following awards and commendations in 2012:

- Asian Banking & Finance: Malaysia Domestic Technology & Operations Bank of the Year

- Bank Negara Malaysia (BNM): First bank in Malaysia to spearhead BNM's new recycling framework

- J.P Morgan: Quality Recognition Award for Operational Excellence

- BNY Mellon: Operation in U.S Dollar STP Excellence Award

- Financial Mediation Bureau: Commendation on the 100% Resolution of Outstanding Customer Cases

Service Quality

Service Quality (SQ) aims to steer the bank towards providing top-of-its-class customer experience. In 2012, SQ, with its recently established Service Quality Committee, spearheaded a range of transformation initiatives, projects and campaigns to drive consistency and deliver on the brand promise we make to our customers. This meant nurturing hearts, minds and behaviours.

Improving Complaint Management

Previous surveys conducted have indicated that customers were not happy with our problem resolution. To improve end-to-end problem resolution, in July 2012 we launched Project GIFT "Get Involved and Follow Through". All complaints are now centrally managed at Customer Feedback & Resolution Management (CFRM) to ensure prompt and customer-centric resolution. With the implementation of Project GIFT, complaints received via various touch points are logged into a centralised system. This allows CFRM to focus relentlessly on complaint resolution, ensuring meanwhile that customers are kept updated from start to finish.

From August to December 2012, CFRM improved its Service Level Agreement (SLA) performance by almost 10% despite a 7% increase in the average volume of complaints.

An internal Customer Satisfaction Phone Survey to gauge the average satisfaction level in our complaints handling showed a positive trend for the last quarter of 2012 with a consistent 5.33% increase in satisfaction. This proved to us that we are on the right track, but also indicated that there is plenty more we can do to further enhance customer service.

Improving Frontline Staf Product Knowledge

SQ, in collaboration with Group Organisational Learning, Branch Management, Community Distribution and 11 Core Product owners, embarked on an initiative to improve frontline staff product knowledge. Known as "Project Harry Potter" (PHP), this aims to deepen operational and core product knowledge amongst frontliners to better equip them to answer enquiries and resolve complaints especially in areas which have a big impact on our customers' overall satisfaction level.

To improve learning and gauge effectiveness, we organised quarterly operational and product assessments – including a series of mini competitions – involving 13,797 frontliners nationwide. Besides promoting a knowledge-based culture, the competitions helped make learning more fun.

Improving External Customer Engagement

In July 2012, SQ collaborated with Sectors and Departments at Menara Maybank and Dataran Maybank to launch "Campaign 555" (C555) – an initiative to improve our external customer engagement. The number 555 was derived from our vision to be ranked as one of Malaysia's top five local banks as well as the bank's aspiration to achieve a 55% score in our External Customer Engagement Survey (ECES).

The campaign encourages team spirit, trust and cooperation in serving internal and external customers better and with H.E.A.R.T. (Humility, Efficiency, Appreciation, Respect and Trust).

Meanwhile, as part of the Bank's Service Excellence Recognition Programme, we introduced e-555 as an online platform to recognise our fellow Maybankers who demonstrated our core values through teamwork and relationship-building with colleagues. To date, we have received over 5,900 messages of appreciation.

Maybankers who were recognised as role models via the C555 campaign have also won their rightful place in the Wall of Fame. Their warm and winning smiles will inspire their colleagues to emulate their excellence and efficiency.

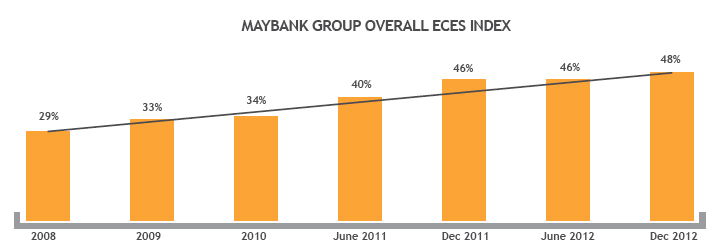

External Customer Engagement Survey (ECES) Index – General Banking (GB) 2008 - 2012

Based on the 2012 ECES, customers are increasingly satisfied with Maybank and are willing to continue using us and recommending us. This was reflected by a 2% increase in the ECES index to 48.3%. It also shows that, although we are moving in the right direction, we still need to strive harder to meet our target customer satisfaction score of 55%.

In comparison to our competitors' ranking, our ECES ranking has improved tremendously. We have reduced the gap from 20% in June 2011 to 4.86% in 2012, indicating that we are closer to achieving our goal.

The Bankwide ECES is a crucial indicator of the level of customer satisfaction with our main delivery channels and indicates that customers are generally satisfied with our main delivery channels such as Self-Service Terminals, Branches, Online Banking (M2U website) and Business Banking.

Improving Branch Average Waiting Time

In line with our customer-centric approach, in 2011 we rolled out an initiative called "Project Narnia" to improve our branches' Average Waiting Time (AWT). The aim was to consistently ensure that customers have to wait no more than two minutes for a single transaction or five minutes for multiple transactions. A year or so into the project, the initiative has already achieved a 30% improvement in AWT.