Statement on Corporate Governance

Introduction

In line with the Group's regional aspirations, the Board has continued to ensure that the highest standards in corporate governance are upheld, with a view to continuously enhancing stakeholder value, increasing investor confidence, establishing customer trust and building a competitive organisation, whilst at the same time not losing sight of its international stakeholders by establishing and overseeing requisite cross-border governance policies and processes.

The Maybank Group's corporate governance model adopts the following requirements and guidelines:

- Malaysian Code on Corporate Governance 2012 (referred to herein as “the Code” or MCCG 2012);

- Bank Negara Malaysia (BNM)'s Revised Guidelines on Corporate Governance for Licensed Institutions (BNM/GP1);

- Bursa Malaysia Securities Berhad (Bursa Malaysia)'s Main Market Listing Requirements (Listing Requirements);

- Green Book on Enhancing Board Effectiveness (Green Book) by the Putrajaya Committee on Government Linked Companies (GLCs) High Performance;

- Corporate Governance Guide (CG Guide) by Bursa Malaysia; and

- Minority Shareholders Watchdog Group (MSWG)'s Corporate Governance Guidelines.

Maybank also monitors developments in corporate governance standards of leading and reputable organisations and institutions in the region and around the world to ensure its approach in Malaysia and in countries in which the Group has a presence is in line with the latest international best practices.

This Corporate Governance Statement aims to provide vital insight to the investors into the corporate governance practices of the Group.

The Board is committed to achieving the highest standards of business integrity, ethics and professionalism across all of the Group's activities. The fundamental approach adopted is to ensure that the right executive leadership, strategy and internal controls for risk management are well in place. Nonetheless, the Board also continuously reviews its governance model to ensure that its relevance, effectiveness and ability to meet the challenges of the future remain sustainable.

The Board informs the shareholders on the application of its corporate governance model and the Code for the financial year ended 31 December 2012, as set out hereunder.

In general, Maybank is in compliance with the Principles set out in MCCG 2012 and such application of the respective principles will be highlighted in various sections in this Corporate Governance Statement as well as this Annual Report.

The Board Of Directors

Board Charter

The Board Manual (Manual) is the key point of reference for directors in relation to the Board's role, powers, duties and functions. The Maybank Board is constantly mindful of the need to safeguard the interests of the Group's shareholders, customers and all other stakeholders, at home, and abroad. Apart from reflecting the current best practices and the applicable rules and regulations, the Manual outlines processes and procedures to ensure the Group's boards and their committees' effectiveness and efficiency. It is a dynamic document to be updated from time to time to reflect changes to the Bank's policies, procedures and processes as well as amended relevant rules and regulations, or to be reviewed at least once in two years, whichever is earlier.

The Group's subsidiaries and associates' boards, both locally and overseas, are encouraged to adopt similar manuals for their respective corporate entities.

The Manual comprises, amongst others, well defined terms of reference as well as authority limits for the Board and its committees, and the various relevant internal policies.

The chapters covered under the Manual are as follows:

- Group's standard of business conduct;

- Directors' duties and obligations;

- Appointment and resignation of Directors;

- Governance structure;

- Board and board committee proceedings;

- Remuneration and benefits for Directors;

- Supply of information to the Board;

- Training and induction programmes;

- Annual Board assessment;

- Conflict of interest and related party transactions; and

- Other key policies of the Bank and the Group.

Roles and Responsibilities of the Board

The Maybank Board is responsible for the periodic review and approval of the overall strategies, business, organisation and significant policies of the Bank and the Group. The Board also sets the Group's core values, adopts proper standards to ensure that the Bank operates with integrity, and complies with the relevant rules and regulations.

The Board has a formal schedule of matters reserved for its decision which include, amongst others, the following:

- Reviewing and approving the strategies and business plans for the Bank and Group;

- Identifying and managing principal risks affecting the Group including establishing and approving the relevant policies for the prevention of money laundering, and anticompetitive practices;

- Reviewing the adequacy and integrity of the Group's internal control systems;

- Overseeing the conduct and the performance of the Group's businesses;

- Reviewing succession planning and talent management plans for the Group, and approving the appointment and compensation of senior management staff;

- Approving new policies pertaining to boardroom diversity, staff salary and benefits;

- Approving changes to the corporate organisation structure;

- Approving the appointment of Directors and Directors' emoluments and benefits in accordance with relevant statutes;

- Approving policies relating to corporate branding, public relations, investor relations and shareholder communication programmes; and

- Reviewing the Group's strategies on promotion of sustainability focusing on environmental social and governance (ESG) aspects.

Other than as specifically reserved to the Board in the Board's Terms of Reference, the responsibility for managing Maybank's business activities is delegated to the President & Chief Executive Officer (PCEO) of the Bank, who is accountable to the Board.

Board Composition and Balance

There are currently 12 Directors on the Maybank Board. Nine are Independent Non-Executive Directors, two are Non- Independent Non-Executive Directors (nominees of Permodalan Nasional Berhad (“PNB”)) and one is a Non-Independent Executive Director (the PCEO).

The present composition of the Board is in compliance with Chapter 15.02 of the Listing Requirements as more than half of its members are Independent Directors.

The Board is committed to ensuring diversity and inclusiveness in its composition and deliberations. The Board has taken note of Recommendation 2.2 of the MCCG 2012 pertaining to the establishment of policy formalising its approach to boardroom diversity and steps are now being taken to review the Manual taking into consideration the recent announcement by the Government on gender diversity and the number of women directors that should be appointed by 2016, and has initiated deliberation to review the internal policy to enable the target to be achieved. Mindful that the Group's operations are getting bigger outside Malaysia, the Board, however, has also ensured diversity through representation of non-Malaysians, and always focuses on selecting the right candidates who can bring value and expertise to the Board.

The Directors provide a wealth of knowledge, experience and skills in the key areas of accountancy, law, securities, international business operations and development, finance and risk management, amongst others. A brief profile of each member of the Board is presented on pages 174 to 181 of this Annual Report.

As affirmed by the Board, the selection of Directors is based on merit, and guided by the criteria outlined in the Group's Policy on Fit and Proper Criteria for Appointment/ Reappointment of Key Responsible Persons of Licensed Institutions in Maybank Group (Fit and Proper Policy) as duly assessed by the Nomination and Remuneration Committee (NRC).

Director independence and Independent Non-Executive Directors

The current Board composition, which comprises a high proportion of Independent Non-Executive Directors, helps the Board to ensure and provide strong and effective oversight over management. The composition also reflects the interest of the Bank's majority shareholder which is adequately represented by the appointment of its nominee directors, balancing the interest of the minority shareholders. The Non-Executive Directors do not participate in the day-to-day management of the Bank and do not engage in any business dealing or other relationships with the Bank (other than in situations permitted by the applicable regulations) in order to ensure that they remain truly capable of exercising independent judgement and act in the best interests of the Group and its shareholders. Further, the Board is satisfied and assured that no individual or group of Directors has unfettered powers of decision that could create a potential conflict of interest.

The Non-Executive Directors of Maybank continue to proactively engage with senior management and other relevant parties such as the external/internal auditors as well as the Bank's Compliance and Risk units, to ensure that the various concerns and issues relevant to the management and oversight of the business and operations of the Bank and the Group are properly addressed. The Board's commitment to ensure good governance in its deliberation on key issues is evident with the scheduling of “Board Time Without Management” as a permanent item in the monthly Board meeting agenda (at the end of each meeting).

In line with the requirements of BNM/GP1, none of the Bank's Independent Non-Executive Directors has more than a 5% equity interest in the licensed institution or in its related companies, and none of them is connected to a substantial shareholder of the licensed institution.

Additionally, the Board ensures that all Independent Non- Executive Directors possess the following qualities:

- Ability to challenge the assumptions, beliefs or viewpoints of others with intelligent questioning, constructive and rigorous debating, and dispassionate decision making in the interest of the Bank;

- Willingness to stand up and defend their own views, beliefs and opinions for the ultimate good of the Bank; and

- A good understanding of the Bank's business activities in order to appropriately provide responses to the various strategic and technical issues confronted by the Board.

The Board considers that the nine Independent Non-Executive Directors (NEDs), namely Dato' Mohd Salleh Hj Harun, Tan Sri Datuk Dr Hadenan A. Jalil, Dato' Seri Ismail Shahudin, Dato' Dr Tan Tat Wai, Dato' Johan Ariffin, Mr. Cheah Teik Seng, Mr. Alister Maitland, Datuk Mohaiyani Shamsudin, and Mr. Erry Riyana Hardjapamekas meet the said requirements.

Senior Independent Non-Executive Director

In accordance with the best practices in corporate governance, Tan Sri Datuk Dr Hadenan A. Jalil continues to play his role as the Senior Independent Director (SID) of the Board to whom concerns of shareholders and stakeholders may be conveyed. He is responsible for addressing concerns that may be raised by the shareholders. Tan Sri Datuk Dr Hadenan A. Jalil is also the Chairman of the Audit Committee of the Board and a member of the Nomination and Remuneration Committee.

He can be contacted at his email address: adenan.aj@maybank.com.my.

Board Appointment Process

A formal and transparent procedure exists vis-ŕ-vis the appointment of new Directors to the Board, the primary responsibility of which has been delegated to the Nomination and Remuneration Committee (NRC). This procedure is in line with the Group's Fit and Proper Policy (which has been in force since August 2006) and BNM/GP1. Under this procedure, the NRC recommends to the Board suitable candidates for directorships and the appointment of key senior management of the Bank and relevant subsidiaries. The NRC also ensures candidates possess the requisite skills and core competencies to be deemed fit and proper, and to be appointed as Director in accordance with the Fit and Proper Policy, the Listing Requirements and the MCCG 2012 issued by the Securities Commission.

Maybank's Fit and Proper Policy, which sets out the attributes and qualifications required of a candidate to determine his/ her suitability, include amongst others, requirements in respect of his/her management and leadership experience, which has to be at the most senior level in a reputable local or international financial services group, public corporation or professional firm/body. In relation to the candidate's skills, expertise and background, the candidate should ideally and to the extent available, possess a diverse range of skills, including in particular, business, legal and financial expertise, professional knowledge and financial industry experience, as well as experience in regional and international markets.

In making the selection, with the assistance of the NRC, the Board considers the following aspects:

- Probity, personal integrity and reputation – the person must have key qualities such as honesty, integrity, diligence, independence of mind and fairness.

- Competence and capability – the person must have the necessary skills, ability and commitment to carry out the role.

- Financial integrity – the person must manage his debts or financial affairs prudently.

The Fit and Proper Policy assists in identifying the gaps in skills in the composition of the Board. In place since 2007, the Policy outlines the requirement for Non-Executive Directors of Maybank who have reached the age of 70 and above, and those who have served the Board for 12 years or more to submit their resignation letters annually to the NRC six months before the Annual General Meeting (AGM), for appropriate recommendations to be made to the Board. The Board acknowledges the view of the Minority Shareholders Watchdog Group that has now been incorporated in MCCG 2012, that an appropriate term for Independent Non-Executive Directors should not be more than nine years. The Board is likely to deliberate on a possible change of its policy in this regard in due course.

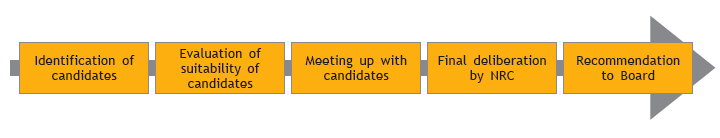

The nomination process is clearly and transparently set out as per the policy on the Nomination Process for the Appointment of Chairman, Director and CEO of Licensed Institutions in the Group (Policy on Nomination Process). The nomination process involves the following five stages:-

Subject to the approval of the relevant boards in the Maybank Group the application for the appointment of such candidates is thereafter submitted to BNM for the requisite approval under the Banking and Financial Institutions Act, 1989 (“BAFIA”), Insurance Act 1996 and Takaful Act 1984, as the case may be.

For Executive Directors, the appointment process includes the identification of potential candidates by a special committee of the Board, governed by the expectation of the roles and capabilities described and required by the Board. This is subsequently followed by a submission to the NRC for deliberation to be followed by the final recommendation to the Board for endorsement, and ultimately submission to BNM for approval.

In accordance with the Group's Fit and Proper Policy for Key Responsible Persons (KRPs) and in line with BNM/GP1, the Bank also conducts periodic assessments on the suitability of the Directors to continuously occupy their strategic leadership position, subsequent to the appointment process. The fit and proper assessment for KRPs involves independent checks on the self-declarations made by the Directors as well as any of their business interests connected to the Bank in compliance with section 64 of BAFIA and BNM/GP1 for the purpose of ensuring the Directors are suitable to continue to serve as directors of the Bank.

Directors' Retirement and Re-election

At the first opportunity, post-appointment, all directors of the Bank, including the PCEO, are subject to re-election by the shareholders and are subject to re-election at least once every three years in accordance with the Bank's Articles of Association. The Board's support for a Director's re-election is not automatic and is subject to satisfactory assessment of performance.

The Directors who are due for re-election at the AGM will first be assessed by the NRC, which will then submit its recommendation to the Board for deliberation and approval. Upon obtaining the Board's endorsement, the relevant submission including the justifications for such re-appointment is thereafter made to BNM for approval if the relevant Director's BNM's term of appointment is expiring.

The four Directors who are due for re-election at the forthcoming AGM, as evaluated by the NRC and approved by the Board, have met the Board's expectations and continued to perform in an exemplary manner as demonstrated by inter alia their contribution to the Board's deliberations.

Board and Individual Director's Effectiveness

The NRC undertakes a formal and transparent process, upon the completion of every financial year, to assess the effectiveness of individual Directors, the Board as a whole and its committees, as well as the performance of the PCEO in respect of their respective skills and experience, pursuant to the Board and Peer Annual Assessment exercise.

The Board and Peer Annual Assessment exercise is primarily based on answers to a detailed questionnaire prepared internally by Corporate & Legal Services of Maybank. The assessment questionnaire is distributed to all the respective Board members and covers topics which include, amongst others, the responsibilities of the Board in relation to strategic planning, risk management, performance management, financial reporting, audit and internal process, human capital management, corporate social responsibility, communication, corporate governance, and shareholders' interest and value. Other areas being assessed include Board composition and size, the contribution of each and every member of the Board at meetings, the Board's decision-making and output, information and support rendered to the Board as well as meeting arrangements.

Actionable improvement programmes will be identified, upon review of the results of the Board and committee assessment by the NRC and the Board. Such programmes may include training needs of individual Directors, to be reviewed quarterly thereafter. The Chairman discusses the peer assessment results with individual members whilst the Chairman of the NRC discusses the latter's assessment results with the Chairman of the Board.

Having considered its composition, calibre and diversity, the Board must be satisfied that it will continue to ensure an efficient and effective conduct of deliberations pursuant to BNM/GP1. The current Board size enables the Board to discharge its function in a professional manner in consideration of the size, breadth and complexity of the Group's business activities, domestically and internationally. Future changes to the Board may be made to enhance complementarity of skills and at the same time enable proper succession planning.

As ever, the Chairman tries to ensure that the Board's decisions are reached by consensus (and failing this, reflect the will of the majority), and any concern or dissenting view expressed by any Director on any matter deliberated at meetings of the Board, or any of its Committees, as well as the meetings' decisions, will accordingly be addressed and duly recorded in the relevant minutes of the meeting.

Role and Responsibilities of the Chairman and the President & Chief Executive Officer

The roles and responsibilities of the Chairman and the PCEO are separated with a clear division of responsibilities, defined, documented and approved by the Board, in line with best practices so as to ensure appropriate supervision of the Management. This distinction allows for a better understanding and distribution of jurisdictional responsibilities and accountabilities. The clear hierarchical structure with its focused approach and attendant authority limits also facilitates efficiency and expedites informed decision-making.

Chairman

Tan Sri Dato' Megat Zaharuddin Megat Mohd Nor is the Chairman of Maybank. Prior to his appointment as the Chairman of Maybank on 1 October 2009, he was an Independent Non-Executive Director of Maybank from July 2004 until February 2009. He has never assumed an executive position in Maybank.

Previously, he has also chaired two other public listed companies, namely Shell Refining Company Berhad and Maxis Communications Berhad.

The Chairman leads the Board and is also responsible for the effective performance of the Board. He continuously works together with the rest of the Board in setting the policy framework and strategies to align the business activities driven by the senior management with the Group's objectives and aspirations, and monitors its implementation, and also ensures orderly conduct and proceedings of the Board, where healthy debate on issues being deliberated is encouraged to reflect an appropriate level of scepticism and independence.

He takes the lead to ensure the appropriateness and effectiveness of the succession planning programme for the Board and senior management levels. He also promotes a healthy working relationship with the PCEO and provides the necessary support and advice as appropriate. He continues to demonstrate the highest standards of corporate governance practices and ensures that these practices are regularly communicated to the stakeholders.

The President & CEO

Dato' Sri Abdul Wahid Omar has been the PCEO and Executive Director of Maybank since May 2008.

In his capacity as PCEO, Dato' Sri has been delegated certain responsibilities by the Board and is primarily accountable for overseeing the day-to-day operations to ensure the smooth and effective running of the Group. Furthermore, he is responsible for mapping the medium to longer term plans for Board approval, and is accountable for implementing the policies and decisions of the Board, as well as coordinating the development and implementation of business and corporate strategies, specifically by making sure that they are carried through to their desired outcomes, especially in the institution of remedial measures to address identified shortcomings. He is also responsible for developing and translating the strategies into a set of manageable goals and priorities, and setting the overall strategic policy and direction of the business operations, investment and other activities based on effective risk management controls.

The PCEO ensures that the financial management practice is performed at the highest level of integrity and transparency for the benefit of the shareholders and that the business and affairs of the Bank are carried out in an ethical manner and in full compliance with the relevant laws and regulations.

The PCEO is also tasked with ensuring that whilst the ultimate objective is maximising total shareholder return, social and environmental factors are not neglected, and also developing and maintaining strong communication programmes and dialogues with the shareholders, investors, analysts as well as employees, and providing effective leadership to the Group organisation. He is also responsible for ensuring high management competency as well as the emplacement of an effective management succession plan to sustain continuity of operations. The PCEO, by virtue of his position as a Board member, also functions as the intermediary between the Board and senior management.

Board Meetings

The Board meets every month with additional meetings convened as and when urgent issues and/or important decisions are required to be addressed between the scheduled meetings. During the financial year ended 31 December 2012, the Board met 18 times to deliberate and consider a variety of significant matters that required its guidance and approval.

All Directors have complied with the requirement that Directors must attend at least 75% of Board meetings held in the financial year in accordance with BNM/GP1, and attended at least 50% of Board meetings held in the financial year ended 31 December 2012 pursuant to the Listing Requirements.

The current practice is to appoint Board members to sit on subsidiary boards, in particular those of the key overseas subsidiaries, to maintain oversight and ensure the operations of the respective subsidiaries are aligned with the Group's strategies and objectives. Moving forward, in order to further ensure that the Group's governance remains linked with strategic and operational focus in line with Maybank's corporate aspirations and expanding regional footprint, more of the key members of the Group Executive Committee shall also have requisite membership on subsidiary level boards.

Details of attendance of each Director on the Board and respective Board Committees of the Bank during the financial year ended 31 December 2012 are as follows:-

| Name of Directors | Board Number of Meetings | CRC Number of Meetings |

ACB Number of Meetings |

||||||

|---|---|---|---|---|---|---|---|---|---|

| Held | Attended | % | Held | Attended | % | Held | Attended | % | |

| Tan Sri Dato' Megat Zaharuddin Megat Mohd Nor | 18 | 18 | 100 | - | - | - | - | - | - |

| Dato' Mohd Salleh Hj Harun | 18 | 15 | 83 | ||||||

| Dato' Sri Abdul Wahid Omar | 18 | 18 | 100 | 50 | 39 | 78 | - | - | - |

| Tan Sri Datuk Dr Hadenan A. Jalil | 18 | 15 | 83 | - | - | - | 14 | 14 | 100 |

| Dato' Seri Ismail Shahudin | 18 | 16 | 89 | 50 | 33 | 66 | - | - | - |

| Dato' Dr Tan Tat Wai | 18 | 18 | 100 | - | - | - | - | - | - |

| Encik Zainal Abidin Jamal | 18 | 18 | 100 | 50 | 38 | 76 | - | - | - |

| Mr. Alister Maitland | 18 | 17 | 94 | - | - | - | - | - | - |

| Mr. Cheah Teik Seng | 18 | 18 | 100 | - | - | - | 14 | 14 | 100 |

| Dato' Johan Ariffin | 18 | 17 | 94 | 50 | 36 | 72 | 14 | 14 | 100 |

| Dato' Sreesanthan Eliathamby1 | 5 | 4 | 80 | - | - | - | 3 | 3 | 100 |

| Datuk Mohaiyani Shamsudin2 | 18 | 17 | 94 | 46 | 37 | 80 | - | - | - |

| Mr. Erry Riyana Hardjapamekas3 | 10 | 10 | 100 | 7 | 7 | 100 | - | - | - |

| Name of Directors | RMC Number of Meetings |

NRC Number of Meetings |

ESS Number of Meetings |

||||||

|---|---|---|---|---|---|---|---|---|---|

| Held | Attended | % | Held | Attended | % | Held | Attended | % | |

| Dato' Mohd Salleh Hj Harun | - | - | - | 11 | 11 | 100 | 6 | 6 | 100 |

| Tan Sri Datuk Dr Hadenan A. Jalil | - | - | - | 11 | 9 | 82 | 6 | 5 | 83 |

| Dato' Dr Tan Tat Wai | 9 | 9 | 100 | 11 | 11 | 100 | 6 | 6 | 100 |

| Encik Zainal Abidin Jamal | - | - | - | 11 | 10 | 91 | 6 | 5 | 83 |

| Mr. Alister Maitland | 9 | 8 | 89 | 11 | 10 | 91 | 6 | 5 | 83 |

| Mr. Cheah Teik Seng | 9 | 9 | 100 | - | - | - | - | - | - |

| Dato' Sreesanthan Eliathamby | 2 | 2 | 100 | - | - | - | - | - | - |

Notes:-

* All Board and Board Committee members met the minimum percentage required for meeting attendance. For the CRC, the requirement is a

minimum of 60% attendance during any financial year.

1 Retired from the Board of Directors (as well as the RMC and the ACB) with effect from 29 March 2012.

2 Appointed as a member of the CRC with effect from 19 January 2012.

3 Appointed as a member of the Board of Directors and the ACB with effect from 25 June 2012.

Directors' Remuneration

The level of directors' remuneration is generally set to be competitive to attract and retain Directors of such calibre to provide the necessary skills and experience as required and commensurate with the responsibilities for the effective management and operations of the Group. In 2010, the Board appointed Messrs. PricewaterhouseCoopers (PwC), to undertake an independent and holistic review of the Bank's remuneration framework. PwC coincidentally was also commissioned by Bank Negara Malaysia – Financial Institutions Directors' Education (BNM-FIDE) to assess the framework for remunerating NED given the aftermath of the global financial crisis. Post-review, the existing remuneration framework was approved by the Board on 30 July 2010 and shareholders in the 50th AGM of Maybank held in 29 September 2010.

Internal initiatives, driven by Group Corporate and Legal Services are also undertaken to continuously validate the existing remuneration framework.

The component parts of the remuneration of the Executive Director are structured so as to link short and long-term rewards to corporate and individual performance. A significant portion of the Executive Director's compensation package has been made variable in nature depending on the Group's performance during the year, which is determined based on the individual Key Performance Indicators and a scorecard aligned with the corporate objectives, and approved by the Board.

The level of responsibilities undertaken by the respective Non-Executive Directors (NEDs) such as on membership of Committees generally determines the level of remuneration to be received. The determination of remuneration packages for NEDs including the non-executive Chairman is a matter for the Board as a whole following the relevant recommendation made by the NRC after independent benchmarking with relevant external peers.

The current remuneration policy of the Directors comprises the following:

- Basic salary

Basic salary of the Executive Director is based on the recommendation of the NRC, after independent benchmarking with relevant external peers.

- Director's fees and meeting allowances (effective 1 July 2010)

For the Board of Directors, fees are RM300,000 per annum for the Chairman, RM285,000 per annum for the Vice Chairman and RM190,000 per annum for each NED. The meeting allowance for the Board is RM1,500 per meeting.

For the Board Committees, RM45,000 per annum for the Board Committee Chairman and RM30,000 per annum for each Committee member. The meeting allowance for Board Committees is RM1,000 per meeting.

- Benefits-in-kind and emoluments

Benefits for NEDs include medical coverage, insurance coverage (Group Personal Accident, Group Term Life and Directors & Officers' Liability), travel benefits, mobile electronic devices and use of Maybank holiday apartments/bungalows.

The Chairman is also paid monthly other emoluments which commensurate with responsibilities befitting his position, for example in representing the Group and facilitating organisation capability building.

At the Extraordinary General Meeting of Maybank held on 13 June 2011, its shareholders had approved the Employees' Share Scheme (ESS) which provides for the offer and grant of options to eligible employees. The EGM also approved the allocation of options and/or grant of shares to the PCEO, to subscribe up to a maximum of 5,000,000 Maybank Shares. The number of shares to be offered to the PCEO, being an eligible employee, under the ESS will be based on both the Bank's and his own performance achievement at the end of the financial year, as specified in the Group/PCEO Balanced Score Card.

The NEDs are not eligible to participate in the current ESS.

A summary of the total remuneration of the Directors, distinguishing between Executive and Non-Executive Directors, in aggregate with categorisation into appropriate components for the financial year ended 31 December 2012 is as follows:-

| Salary (RM) |

Bonus (RM) |

Directors' Fees (RM) |

Other Emoluments (RM) |

Benefits in kind (RM) |

ESS (RM) |

Total (RM) |

|

|---|---|---|---|---|---|---|---|

| Executive Director | |||||||

| Dato' Sri Abdul Wahid Omar | 1,632,000 | 2,380,000 | 854,800 | 42,136 | 1,353,749 | 6,262,685 | |

| TOTAL | 1,632,000 | 2,380,000 | 854,800 | 42,136 | 1,353,749 | 6,262,685 | |

| Non-Executive Directors | |||||||

| Tan Sri Dato' Megat Zaharuddin Megat Mohd Nor | 300,000 | 577,000 | 39,640 | 916,640 | |||

| Dato' Mohd Salleh Hj Harun | 375,000 | 41,000 | 33,946 | 449,946 | |||

| Tan Sri Dr Hadenan A. Jalil | 295,000 | 52,000 | 2,671 | 349,671 | |||

| Dato' Seri Ismail Shahudin | 235,000 | 57,000 | 375 | 292,375 | |||

| Dato' Dr Tan Tat Wai | 295,000 | 53,000 | 200 | 348,200 | |||

| Encik Zainal Abidin Jamal | 280,000 | 80,000 | 2,283 | 362,283 | |||

| Mr. Alister Maitland | 280,000 | 48,500 | 328,500 | ||||

| Mr. Cheah Teik Seng | 250,000 | 50,000 | 2,871 | 302,871 | |||

| Dato' Johan Ariffin | 250,000 | 75,500 | 2,769 | 328,269 | |||

| Dato' Sreesanthan Eliathamby | 62,500 | 11,000 | 73,500 | ||||

| Datuk Mohaiyani Shamsudin | 220,000 | 62,500 | 200 | 282,700 | |||

| Mr. Erry Riyana Hardjapamekas | 113,667 | 22,000 | 50 | 135,717 | |||

| TOTAL | 2,956,167 | 1,129,500 | 85,005 | 4,170,672 | |||

| GRAND TOTAL | 1,632,000 | 2,380,000 | 2,956,167 | 1,984,300 | 127,142 | 1,353,749 | 10,433,357 |

Note:

Executive Director's Other Emoluments include allowance and reimbursements.

Quality and Supply of information to the Board

In order to effectively discharge its duties, the Board has full and unrestricted access to all information pertaining to the Bank's businesses and affairs as well as to the advice and services of the senior management of the Group. In addition to formal Board meetings, the Chairman maintains regular contact with the PCEO to discuss specific matters, and the latter assisted by the Company Secretary ensures that frequent and timely communication between the senior management and the Board is maintained at all times as appropriate.

The Board is regularly kept up to date on and apprised of any regulations and guidelines, as well as any amendments thereto issued by Bank Negara Malaysia, Bursa Malaysia, Securities Commission, the Companies Commission of Malaysia and other relevant regulatory authorities including recommendations on corporate law reform in respect of Malaysian as well as relevant foreign jurisdictions, particularly the effects of such new or amended regulations and guidelines on directors specifically, and the Bank and the Group generally.

A key recent update is in respect of changes expected to take place, affecting financial institutions following the passing by Parliament of the new Financial Services Bill 2012.

The mechanism of the Annual Board Outline Agenda aims to highlight to the Board and relevant Board Committees as well as the senior management subject matters other than ‘routine' for the period to facilitate better planning and for greater time effectiveness for various parties. It also gives a greater sense of discipline on the part of senior management to commit to the said outline. At the same time, such focus allows the Board to deliberate on and contribute towards achieving a higher level of value-added discussions on such identified issues and other relevant matters.

Ahead of each Board meeting, an agenda together with appropriate papers for each agenda item to be discussed is forwarded to each Director at least five clear days before the scheduled meeting to enable the Directors to review the papers in preparation for the meeting, and to obtain further clarification or explanation, where necessary, in order to be adequately apprised before the meeting.

In addition to this, and in line with the provisions of the Code, the Bank's minutes of meetings of the Board and various Board Committees incorporate the discussions of the members at the meetings in arriving at decisions and are concise and accurate. The draft minutes of the meeting are circulated within one week of the meetings to the Board for early feedback and suggestions prior to tabling at the subsequent meetings for formal confirmation.

Senior management members are invited to attend Board meetings to report on matters relating to their areas of responsibility, and also to brief and present details to the Directors on recommendations submitted for the Board's consideration. Additional information or clarification may be required to be furnished, particularly in respect of complex and technical issues tabled to the Board.

Company Secretary

The General Counsel and Company Secretary, in his function as the Company Secretary, is responsible for advising the Board on issues relating to corporate compliance with the relevant laws, rules, procedures and regulations affecting the Board and the Group, as well as best practices of governance. He is also responsible for advising the Directors of their obligations and duties to disclose their interest in securities, disclosure of any conflict of interest in a transaction involving the Bank, prohibition on dealing in securities and restrictions on disclosure of price-sensitive information.

All Directors have access to the advice and services of the Company Secretary and the Board Satisfaction Index acts as an evaluation mechanism on the support and services provided by the Company Secretary to the Board during the financial year.

Board Satisfaction Index (BSI)

The BSI demonstrates an important initiative to ensure continuing adequate support is provided by the Company Secretary to the Board, to assist Directors in discharging their duties effectively. The BSI exercise was conducted in December 2012 for the financial year ended 31 December 2012.

The areas of assessment cover transactional and operational efficiency, which includes the quality of the minutes of the Board and Board Committees, of papers and meeting arrangements, and of training and knowledge management, as well as advisory services on matters concerning Directors' duties, such as disclosure of interests and prohibition against trading. Based on feedback received from Board members, the Board was generally satisfied with the support provided for the year under review and several areas were identified for further improvement.

Independent Professional Advice

Individual Directors may obtain independent professional advice at the Bank's expense where necessary, in the furtherance of their duties in accordance with the Bank's Policy and Procedure on Access to Independent Professional Advice, Senior Management and Company Secretary by Directors of Maybank Group. Copies of any reports, advice and recommendations provided by the independent professional adviser to the relevant Director would be forwarded by the said Director to the Company Secretary, who will, where appropriate, circulate them to other Directors to ensure that they are kept informed of pertinent issues, which may have an impact on the Group's interest, growth and performance.

During the financial year ended 31 December 2012, none of the Directors invoked this process for independent professional advice.

Structured Training Programme for Directors

Through a Structured Training Programme for Directors (STPD), each Director shall attend at least one training programme, which is to be specifically developed by the organisation for its Directors during the financial year.

For the year under review, all the Board members complied with the aforesaid internal policy by attending various training programmes and workshops on issues relevant to the Group, which were organised internally, as well as in collaboration with external training providers. As commenced in 2010, Board members have attended a key training programme for Directors of financial institutions, namely the Financial Institutions Directors' Education (FIDE). Effective June 2012 the Maybank Group also became a registered corporate member of the FIDE Forum, which was established with the aim of allowing FIDE alumni members to become leading influencers of governance practices and thought leaders within financial institutions, and to benefit from, amongst others, the roundtree discussions, and industry update sessions and materials provided by subject matter specialists. For further details on the FIDE Forum, please refer to www.fide.org.my.

Corporate & Legal Services coordinates a comprehensive induction programme for new Directors in order to provide new Directors with the necessary information and overview to assist them in understanding the Group's operations and appreciating the challenges and issues the Group faces in achieving its objectives. The programme covers subject matters, amongst others, concerning the Group's business and strategy, work processes and Board Committees, and the duties and responsibilities of Directors of licensed institutions.

The Board has undertaken an assessment of the training needs of its Directors vide the Board Assessment and the key areas of focus for training programmes attended by the Directors for the financial year ended 31 December 2012 were as follows:

Board Effectiveness:

- FIDE Elective Programme on Nomination and Remuneration Committee.

- FIDE Core Programme Module A – The objective is to emphasise and reinforce a clear understanding of the role of the Board and fiduciary responsibilities of individual directors to all stakeholders by deepening the Board's understanding of principles of sound governance. This includes studying the lessons from within best-in-class organisations and understanding how they inculcate values throughout the organisations and promote organisational values and effectiveness. The Board is also equipped with tools and strategies that can be applied to build a dynamic and sustainable management team.

- FIDE Core Programme Module B – The objective is to encourage the adoption of more structured and robust processes for the selection of board members and on-going assessment of board effectiveness to achieve an optimal board mix and heighten awareness of the impact of internal conflicts and effects of dominant influences associated with controlled companies. It also provides an understanding of the key issues in financial reporting and helps directors to discharge their responsibilities effectively for ensuring the integrity of financial reports. The Board is equipped with the know-how to set or review strategies that create value for the organisation, and to be able to identify when strategies need to be adapted in response to changing business and market conditions as well as to identify and avoid common pitfalls in strategy execution.

Corporate Governance:

- The 4th Annual Corporate Governance Summit KL 2012

– Bringing Asia onto the Board - The Islamic Finance News Forum

- The World Islamic Economic Forum

Risk Management:

- FIDE Elective Programme – Risk Management Committee in Banks

- The Maybank Annual Risk Workshop (organised internally by Group Credit and Risk Management)

As at the end of the financial year ended 31 December 2012, all Directors are in adherence to the Mandatory Accreditation Programme in compliance with the Listing Requirements.

Board Profesionalism

Directorships in Other Companies

The Maybank Board is already in compliance with the Listing Requirements, which stipulate that each member of the Board hold not more than five directorships in public listed companies. This is also consistent with the best practices recommendation of the Green Book which states that directors should not sit on the boards of more than five listed companies to ensure that their commitment, resources and time are more focused to enable them to discharge their duties effectively.

Related to the issue of external commitments of the members of the Board, whilst the Board values the experience and perspective gained by the Non-Executive Directors from their services on the boards of other companies, organisations, and associations, the Board Manual, since 2010, provides that the Non-Executive Directors must first consult the Chairman to ensure that their acceptance of such other appointments, such as directorships of other listed companies, would not unduly affect their time commitments and responsibilities to the Maybank Board and Group. The Board notes that this requirement is now also stipulated in MCCG 2012.

Further, although the Independent Non-Executive Directors hold directorships in several companies in the Maybank Group, the NRC assesses the independence of the said Directors pursuant to a declaration made that they are not taking instructions from any person including Maybank. In this respect, all the Independent Non-Executive Directors of Maybank complied with the relevant requirements of BNM/GP1. In addition, the respective key subsidiaries within the Group also appoint other Independent Non-Executive Directors who are not members of the Maybank Board to ensure an optimal balance between board members in terms of independent internal and external directors.

Conflict of Interest

It has been the practice of Maybank to require that members of the Board make a declaration to that effect at the Board meeting in the event that they have interests in proposals being considered by the Board, including where such interest arises through close family members, in line with various statutory requirements on the disclosure of Director's interest. Any interested Directors would then abstain from deliberations and decisions of the Board on the subject proposal and, where appropriate, excuse themselves from being present in the deliberations.

Insider Trading

In line with the Listing Requirements and the relevant provisions of the Capital Markets & Services Act 2007, Directors, key management personnel and principal officers of the Maybank Group are prohibited from trading in securities or any kind of property based on price sensitive information and knowledge, which have not been publicly announced. Notices on the closed period for trading in Maybank's securities are circulated to Directors, key management personnel and principal officers who are deemed to be privy to any price sensitive information and knowledge, in advance of whenever the closed period is applicable.

Board Committees

The Board delegates certain of its governance responsibilities to the following Board Committees, which operate within clearly defined terms of references, primarily to assist the Board in the execution of its duties and responsibilities. Although the Board has granted such discretionary authority to these Board Committees to deliberate and decide on certain key and operational matters, the ultimate responsibility for final decision on all matters lies with the entire Board.

Audit Committee

The Audit Committee is authorised by the Board to investigate any activities within its Terms of Reference and has unrestricted access to both the internal and external auditors and members of the senior management of the Group. The activities carried out by the Audit Committee, which met 14 times during the year under review, are summarised in the Audit Committee Report and its Terms of Reference as stated on page 216 of this Annual Report. Members of the Audit Committee are as indicated on page 216 of this Annual Report.

Credit Review Committee

The responsibilities of the Credit Review Committee include, amongst others, the following:

- To review/veto loans exceeding the Group Management Credit Committee's (GMCC) discretionary power;

- To review/veto, with power to object or support, all proposals recommended by the GMCC to the Board for approval/affirmation, including but not limited to statute and policy loans;

- To affirm new and existing Group exposure; and

- To carry out such other responsibilities as may be delegated to it by the Board from time to time.

The Committee meets weekly and during the financial year ended 31 December 2012, the Committee met 50 times. Members of the Credit Review Committee and details of meeting attendance by members are stated on page 199 of this Annual Report.

Nomination and Remuneration Committee (NRC)

The NRC comprises exclusively Non-Executive Directors, the majority of whom are independent and presently chaired by the Independent Vice Chairman of Maybank.

The responsibilities of the NRC include, amongst others, the following:

- To recommend to the Maybank Board, the appointment, promotion and remuneration as well as compensation policies for executives in key management positions;

- To recommend to the Maybank Board, a Leadership Development framework for the Group;

- To oversee the selection of Directors and general composition of the Maybank Board (size, skill and balance between Executive Directors and Non-Executive Directors);

- To recommend to the Maybank Board, a policy and framework for remuneration of Directors, covering fees, allowances and benefits-in-kind in respect of their work as Directors of all boards and committees and for the PCEO and key senior management officers;

- To assess the performance and effectiveness of individuals and collective members of the Boards and Board Committees of the Group and its subsidiaries, as well as the procedure for the assessment;

- To recommend measures to upgrade the effectiveness of the Boards and Board Committees;

- To recommend to the Maybank Board a performance management framework/model, including the setting of the appropriate performance target parameters and benchmark for the PCEO's Group Balanced Scorecard at the start of each financial year;

- To oversee the succession planning, talent management and performance evaluation of executives in key management positions;

- To consider and recommend solutions to issues of conflict of interest affecting Directors;

- To assess annually that Directors and key senior management executives are not disqualified under section 56 of the BAFIA; and

- To review the training requirements and programmes for the Directors.

The NRC held eleven meetings during the financial year ended 31 December 2012. The deliberations encompassed the following key considerations and subject matter, amongst others:

- Review of the composition of Board Committees and subsidiaries' boards;

- Re-election and retirement by rotation of Directors at the Annual General Meetings of the Maybank Group;

- Annual Board Assessment for the Maybank Board, and the boards of the Group's subsidiaries;

- Fit and Proper Assessment of Directors and senior executives;

- Establishment of Board Committees at the Group's locally incorporated subsidiaries;

- Review and comparative analysis of the remuneration of Non-Executive Directors of subsidiaries of the Maybank Group;

- Implementation of the Maybank Group Variable Bonus Scheme for the Maybank Group;

- Annual Performance and Compensation Review for senior executives;

- Total Compensation Review Implementation for the six-month period ended 31 December 2011 – post mortem;

- Bank Negara Malaysia Concept Paper on Risk Governance dated 23 February 2012 – Highlights on Risk Based Remuneration;

- Proposed appointments of the Group's executives to key management positions within the Group, and the determination of the compensation packages pertaining thereto;

- Summary of policy and process in respect of the appointment of Maybank Group executives as Directors/ Chief Executive Officer;

- Talent management update; and

- Mandatory Certification Updates and Plan for 2013 in relation to the Certified Credit Professional certification for local operations and Credit Skills Accreditation for Overseas Units.

Members of NRC and details of meeting attendance by members are stated on page 199 of this Annual Report.

Risk Management Committee (RMC)

The responsibilities of the Risk Management Committee for risk oversight include, amongst others, the following:

- To develop and foster a risk aware culture within the Bank;

- To review and approve risk management strategies, risk frameworks, policies, risk tolerance and risk appetite limits, adequacy of risk management policies and framework in identifying, measuring, monitoring and controlling risks and the extent to which they operate effectively;

- To ensure infrastructure, resources and systems are in place for risk management, i.e. that the staff responsible for implementing risk management systems perform those duties independently of the financial institution's risk – taking activities;

- To review and assess the appropriate levels of capital for the Bank, vis-ŕ-vis its risk profile;

- To review and recommend strategic actions to be taken by the Bank for the Board's approval;

- To review and approve new products and ensure compliance with the prevailing guidelines issued by BNM or any other relevant regulatory body;

- To oversee the resolution of BNM Composite Risk Rating findings for the Maybank Group;

- To oversee the specific risk management concerns in the business units that leverage on the Embedded Risk Units in the business units; and

- To review and approve the model risk management and validation framework.

The RMC usually meets nine times in every financial year with additional meetings convened to attend to urgent matters that require its deliberation. During the financial year ended 31 December 2012, nine meetings were held. The Chairman and a majority of the Committee's members are Independent Non-Executive Directors. Members of the RMC and details of attendance by members are stated on pages 199 of this Annual Report.

Employees' Share Scheme Committee (ESS Committee)

The Employees' Share Scheme (ESS) was established to serve as a long-term incentive plan as well as to align the interests of employees with the objectives of the Maybank Group to create sustainable value enhancement for the organisation and the shareholders. The first offer under the ESS was made on 23 June 2011 to all eligible employees.

The Board has delegated to the ESS Committee the responsibility for determining all questions of policy and expediency arising from the administration of the ESS and to generally undertake the necessary actions to promote the Bank's best interest.

The broad responsibilities of the ESS Committee as outlined in its Terms of Reference include to administer the ESS and to recommend the financial and performance targets/criteria to the Board for approval prior to implementation and such other conditions as it may deem fit.

All members of the ESS Committee are Non-Executive Directors. Meetings are held as and when the ESS Committee is required to deliberate on urgent matters.

Six meetings of the ESS Committee were held during the financial year under review.

Members of the ESS Committee and details of meeting attendance by members are stated on page 199 of this Annual Report.

Executive Level Management Committees (ELC)

The PCEO, with the support of the Maybank Board, has established various ELCs and delegated some of his authority to assist and support the relevant Board Committees in the operations of the Bank. The key ELCs, which are mostly chaired by the PCEO or the Group Chief Financial Officer, are as follows:-

- Group Executive Committee

- Group Management Credit Committee

- Internal Audit Committee

- Executive Risk Committee

- Asset and Liability Management Committee

- Group Staff Committee

- Group Procurement Committee

- Group IT Steering Committee

Investor Relations And Shareholder Communication

Investor Relations (IR) plays an important role as part of Maybank's corporate governance framework to ensure that shareholders, stakeholders, investors and the investment community, both domestic and international, are provided with relevant, timely and comprehensive information about the Group. Maybank's dedicated IR unit is committed to providing effective and open two-way communication in order to improve disclosure and transparency.

The Maybank Investor Relations Policy provides the framework of policies, procedures and processes upon which Maybank can successfully implement its Investor Relations programme while providing guidance for communication through its designated spokespersons. The Investor Relations programme is carried out during the year to ensure a planned sequence of activities is conducted throughout the year to communicate its strategy, operational performance, financial results and other material developments to the exchange (Bursa Malaysia), analysts, investors, shareholders and other stakeholders in a timely, open and comprehensive manner.

Quarterly Results

Maybank's quarterly financial results are released during the midday trading break followed immediately by media and analyst briefings and/or conference calls. Media and analyst briefings are conducted with simultaneous conference calls during the half-year and full year financial results while conference calls are conducted for the first and third quarter. Financial statements, presentation slides and press releases are emailed and are also publicly available on the corporate website to provide stakeholders with a better understanding of Maybank's performance. A quiet period of two weeks preceding the results announcement date is adopted to prevent inadvertent disclosure of the latest financial performance.

Conferences and Roadshows

Stakeholder engagements are also conducted through conferences and roadshows organised locally or overseas whereby senior management will communicate the Group's strategy, and the progress of various initiatives and updates to enable stakeholders to understand Maybank's operations better.

Investor Meetings

The IR unit has frequent one-on-one and group meetings with analysts, investors and potential investors throughout the year to provide constant communications with the investment community. Reasonable access to senior management is also provided to ensure analysts and important investors are able to meet with key executives within the Group. The IR unit also engages with its counterpart in Indonesia, to coordinate IR activities for analysts and investors seeking meetings with the management of Maybank's subsidiary, Bank Internasional Indonesia.

Investor Days

Investor days are organised several times a year to provide a platform for selected business units, headed by their respective Executive Committee members, to engage with analysts and investors in order to explain their business strategy, operations and financial performance so as to provide greater transparency and detailed understanding of key business functions within the Maybank Group.

Group Corporate Website

Maybank's corporate website at www.maybank.com provides quick access to information about the Group. The information on the website includes corporate profile, senior management profiles, share and dividend information including the Dividend Reinvestment Plan, investor presentations, financial results, annual reports, corporate news and Maybank's worldwide operations and subsidiaries.

Visitors can also receive the latest updates on Maybank by e-mail and RSS by subscription on the website. In addition, Bursa Link is another channel for stakeholders to obtain Maybank's announcements to the exchange and is available on the Bursa Malaysia website at www.bursamalaysia.com.

Annual Report

Maybank's annual report provides a comprehensive report on the Group's operations and financial performance. The annual report provides full disclosure and is in compliance with the relevant regulations to ensure greater transparency. The annual reports are also printed in summary form together with a digital version of the annual report in CD-ROM format. An online version of the Annual Report is also available on Maybank's corporate website.

Media Coverage

Media coverage on the Group and senior management, either through print media or television coverage, is also initiated proactively at regular intervals to provide wider publicity and improve the general understanding of the Group's business among investors and the public.

Credit Rating

Maybank's credit ratings are provided by five rating agencies, namely Standard and Poor's, Fitch Ratings and Moody's Investors Services, RAM Rating Services Berhad (RAM Ratings) and Malaysian Rating Corporation Berhad (MARC), as part of providing an independent flow of information to stakeholders as well as to the general public.

For more information on the investor relations activities conducted during the year, please refer to the Investor Relations section on page 167.

Contact Details of IR Spokespersons:

Mohamed Rafique Merican

Group Chief Financial Officer

Contact: (6)03 2074 7878

Email: rafique@maybank.com.my

Narita Naziree

Head, Group Business Planning & Investor Relations

Contact: (6)03 2074 8017

Email: naritanaziree.a@maybank.com.my

Raja Indra Putra Raja Ismail

Head, Investor Relations

Contact: (6)03 2074 8582

Email: rajaindra@maybank.com.my

General Meetings

The Group's EGMs and AGMs represent the primary platforms for direct two-way interaction between the shareholders, Board and management of the Group. In deference to shareholder democracy and the transparency policy adopted by the Group, shareholder approval is required on all material issues including, but not limited to, the election and appointment of Directors, major mergers, acquisitions and divestments exercises, as well as the appointment of auditors and final dividend payments.

During the last AGM held on 29 March 2012, the attendance of the shareholders was very encouraging as evidenced by the presence of 2,441 shareholders, an improvement over the 1,842 shareholders who attended the 2011 AGM.

In addition to the AGMs and EGMs, shareholders and market observers are also welcome to raise queries at any time through the Corporate Affairs and Group Strategy Management Divisions.

Maybank aspires to take active steps to encourage shareholder participation at the AGMs by serving notices of meeting earlier than the minimum notice period of 21 days, in line with Principle 8 of MCCG 2012 and more importantly Maybank has consistently ensured that its AGM is convened within three months from the end of the financial year.

In line with Recommendation 8.2 of MCCG 2012 on poll voting, Maybank has always made the necessary preparation for poll voting for all resolutions at its AGM. Maybank also takes note of Recommendation 8.2 of MCCG 2012 on e-voting and will explore the suitability and feasibility of employing electronic means for poll voting in view of its large shareholder base and related logistical complexity.

Ownership Structure

The shares of Maybank are widely held with institutional shareholders dominating the ownership structure of Maybank. As at 31 December 2012, the top three shareholders were Skim Amanah Saham Bumiputra (ASB) with 40.58%, Employees Provident Fund Board with 14.09% and Permodalan Nasional Berhad (PNB) with 5.08%, accounting in aggregate for a combined 59.75%.

Although the three top shareholders of Maybank accounted for more than half of the total paid up share capital of Maybank, Maybank is not subject to any biased influence from these shareholders and they do not hold management positions within the organisation. This arrangement ensures a high level of corporate governance and permits the Group to focus on continuously building value for all its shareholders.

Maybank's shareholding structure is transparent and is disclosed on page 230 of this Annual Report. Any updates on the shareholding structure can be obtained on request from the designated management personnel on Investors Relations matters. The existing share structure consists entirely of Ordinary Shares and there are no different classes of Ordinary Shares. There is no foreign shareholding limit and the Bank's Memorandum and Articles of Association does not have any explicit provision(s) that may discourage any acquisition. However, the Bank is subject to BAFIA, which contains certain restrictions on share ownership.

As part of Maybank's effort to expand its liquidity and shareholder base, it has established a Sponsored Level 1 American Depository Receipt Programme (ADR) which has been traded over-the-counter in the United States of America since May 2005 on the basis of one ADR equivalent to two Maybank shares. Maybank Custody Services holds the securities for Maybank and the total number of ADRs outstanding is 7,378,591 as at 31 December 2012. The percentage of the securities for which the ADRs are issued against Maybank's issued and paid-up share capital is 0.09%.

Accountability And Audit

Financial Reporting and Disclosure

The Board has a fiduciary responsibility and takes it upon itself to present to the shareholders and the public at large, a clear, balanced and meaningful evaluation of the Group's financial position, performance and prospects. In order to meet the fiduciary responsibility expected of the Board, the Board with the assistance of the Audit Committee oversees the financial reporting process and the quality of the Group's financial statements to ensure that the reports present a true and fair view of the financial position of the Group and of the Bank as at 31 December 2012 and of the results and cash flows of the Group and of the Bank for the year then ended.

The Board also ensures that the financial treatment of the consolidated accounts under the Group is based on the more stringent requirements and that the financial statements of Maybank are drawn up in accordance with Malaysian Financial Reporting Standards, International Financial Reporting Standards and the requirements of the Companies Act, 1965 in Malaysia.

The scope of the disclosure includes a review of the main sources of revenue by business activity and geography, past year performance analysis and financial adequacy, together with detailed explanation of the changes in the Statement of Financial Position and Income Statements, to facilitate better understanding of the Group's operations. In addition to the Audited Report, the Group also releases its unaudited quarterly financial results on a timely basis. These are accessible on Maybank and Bursa Malaysia's websites.

Internal Controls

The Board has overall responsibility for maintaining sound internal control systems that cover financial controls, operational and compliance controls, governance and risk management to ensure that shareholders' investments, customers' interests and the Group's assets are safeguarded.

The effectiveness of risk management and internal controls is continuously reviewed to ensure that they are working. The Audit Committee (AC) regularly evaluates the effectiveness and adequacy of the Group's internal control systems by reviewing the actions taken on internal control issues identified in reports prepared by Group Internal Audit during its scheduled meetings. The AC also reviews audit recommendations and management responses to these recommendations.

The Statement on Internal Control is furnished on page 213 of this Annual Report and this provides an overview of the state of internal controls within the Group.

Whistleblowing Policy

The Board is satisfied that an adequate framework on whistleblowing, known as the Integrity Hotline (formerly Fraud Reporting Hotline) is in place, having been implemented in 2004. All employees can raise their concerns regarding any misconduct or wrongdoing including but not limited to unethical incidences such as criminal activities or contravention of laws/regulations committed by another employee or any person who has dealings with the Group via the following channels without any fear of retribution:

- Toll-Free Message Recording Line at 1-800-38-8833 or for Overseas at 603-20268112

- Protected Email Address at integrity@maybank.com.my

- Secured P.O. Box Mail Address at P.O. Box 11635, 50752 Kuala Lumpur, Malaysia

These channels protect employees who contemplate “blowing the whistle” against any negative repercussions arising from genuine reporting, and provide an assurance of confidentiality to them. Confidentiality of all matters raised and the identity of the whistleblower are protected under the Policy. Concerns raised anonymously will also be considered provided they are clear and specific. Further details of the Policy are set out on page 214 of this Annual Report.

Relationship with the Auditors

Internal Auditors

The Group Internal Audit reports functionally to the Audit Committee (AC) of the Bank and has unrestricted access to the AC. Its function is independent of the activities or operations of other operating units. The Group Internal Audit regularly evaluates the effectiveness of the risk management process, review the operating effectiveness of the internal controls system and compliance control across the Bank and the Group. The Chief Audit Executive is invited to attend the AC meetings to facilitate the deliberation of audit reports. The minutes of the AC meetings are subsequently tabled to the Board for information and serve as useful references especially if there are pertinent issues that the AC members wish to highlight to the full Board.

External Auditors

The AC and the Board place great emphasis on the objectivity and independence of the Bank's Auditors, namely Messrs. Ernst & Young, in providing relevant and transparent reports to the shareholders. To ensure full disclosure of matters, the Bank's Auditors are regularly invited to attend the AC meetings (as well as the Annual General Meetings), apart from the twice yearly discussions with the AC without the presence of the senior management.

A full report of the AC outlining its role in relation to the internal and external auditors is set out on pages 216 to 220 of this Annual Report.

Maybank Group's Code of Ethics and Conduct

In addition to the Directors' Code of Ethics as set out in the BNM/GP7-Part 1 Code of Ethics: Guidelines on the Code of Conduct for Directors, Officers and Employees in the Banking Industry, and the Company Directors' Code of Ethics established by the Companies Commission of Malaysia, the Group also has a Code of Ethics and Conduct that sets out sound principles and standards of good practice in the financial services industry, which are observed by the Directors and the employees. Both Directors and employees are required to uphold the highest integrity in discharging their duties and in dealings with stakeholders, customers, fellow employees and regulators. This is in line with the Group's Core Values which emphasise behavioural ethics when dealing with third parties and fellow employees.

Corporate Integrity Pledge

The Maybank Group reinforces its commitment to a high level of accountability and transparency by being the first financial institution in Malaysia to sign to the Malaysian Corporate Integrity Pledge in August 2011.

The Pledge is as a result of collaboration among:

- Bursa Malaysia Berhad;

- Companies Commission of Malaysia;

- Malaysian Institute of Integrity;

- Malaysian Anti-Corruption Commission & NKRA Corruption Monitoring & Coordination Division;

- Securities Commission Malaysia; and

- Transparency International Malaysia and the Performance Management and Delivery Unit (PEMANDU), Prime Minister's Office.

This declaration signifies to the public that the Group supports and upholds Anti-Corruption Principles for Corporations in Malaysia as well as working towards creating a business environment that is free from corruption in the conduct of its business and in its interactions with its business partners and the Government.

By signing the Integrity Pledge, Maybank is now listed in the register of signatories that is carried on the website of the Malaysian Integrity Institute, and can be accessed through the website of Bursa Malaysia Berhad.

Corporate Responsibility

The Board is satisfied that a good balance has been achieved between value creation and corporate responsibility. Details of the Group's corporate responsibility initiatives are set out on pages 158 to 166 of this Annual Report.

Competition Act 2010

The Act came into force on 1 January 2012, and to facilitate Groupwide adherence, the Joint Secretariat to the Maybank Group Antitrust Steering Committee (Joint Secretariat) consisting of key representatives from Group Corporate and Legal Services, as well as Group Compliance, developed a Guide to Competition Act 2010 (Guide) which has been shared with the Group EXCO, the Board of Maybank as well as being disseminated to Maybankers at large via the Group's e-portal.

This Guide is intended to assist all Maybankers in understanding the basic elements of the Act and competition law issues generally and to ensure that our business operations and conduct that are not anti-competitive continue as usual. It highlights two key prohibitions under the Act, namely anticompetitive agreements (horizontal and vertical) and abuse of dominant position.

Maybankers have been informed that any further queries, pertaining to this legislation can be directed either by e-mail to the Joint Secretariat or to antitrust@maybank.com.my.

Aditional Compliance Information As At 31 December 2012

Utilisation of Proceeds

- RM3.66 billion private placement of 412,000,000 new

ordinary shares of RM1.00 each in Maybank at an

issue price of RM8.88

- Issued on 11 October 2012. The proceeds raised from the private placement are for the purpose of funding Maybank's working capital and general banking purposes.

- USD800 million Tier 2 Capital Subordinated Notes

- Issued on 20 September 2012. The proceeds raised from the USD Subordinated Notes are for the purpose of funding Maybank's working capital, general banking and other corporate purposes.

- HKD600 million Senior Notes under USD5.0 billion

Multicurrency Medium Term Note Programme

- Issued on 20 July 2012. The proceeds raised from the HKD Senior Notes are for the purpose of funding Maybank's working capital, general banking and other corporate purposes.

- JPY5 billion Senior Notes under USD5.0 billion

Multicurrency Medium Term Note Programme

- Issued on 30 May 2012. The proceeds raised from the JPY Senior Notes are for the purpose of funding Maybank's working capital, general banking and other corporate purposes.

- RM2.1 billion Tier 2 Capital Subordinated Notes

- Issued on 10 May 2012. The proceeds raised from the RM Subordinated Notes are for the purpose of funding Maybank's working capital, general banking and other corporate purposes.

- USD500 million Senior Notes under USD2.0 billion

Multicurrency Medium Term Note Programme

- Issued on 8 May 2012. The proceeds raised from the USD Senior Notes are for the purpose of funding Maybank's working capital, general banking and other corporate purposes.

- HKD700 Senior Notes under USD2.0 billion

Multicurrency Medium Term Note Programme

- Issued on 1 March 2012. The proceeds raised from the HKD Senior Notes are for the purpose of funding Maybank's working capital, general banking and other corporate purposes.

- USD400 million Senior Notes under USD2.0 billion

Multicurrency Medium Term Note Programme

- Issued on 10 February 2012. The proceeds raised from the USD Senior Notes are for the purpose of funding Maybank's working capital, general banking and other corporate purposes.

- Dividend Reinvestment Plan (DRP) – Ongoing

- The net proceeds from the DRP (after deducting estimated expenses of the DRP) are for the purpose of funding the continuing growth and expansion of the Maybank Group.

Share Buy-back

Maybank did not make any proposal for share buy-back during the financial year ended 31 December 2012.

Options, Warrants or Convertible Securities

Maybank did not issue any options, warrants or convertible securities during the financial year ended 31 December 2012, save and except for the options issued pursuant to the Employees' Share Scheme.

Imposition of Sanctions and/or Penalties

There were no material sanctions and/or penalties imposed on Maybank and its subsidiaries, directors or management by the relevant regulatory bodies, which were made public during the financial year ended 31 December 2012.

Non-audit fees

Non-audit fees payable to the external auditors, Ernst & Young, for the year amounted to RM6,094,000 for the Group and RM3,885,000 for the Bank.

Variation in Results

There was no profit forecast issued by Maybank and its subsidiary companies during the financial year ended 31 December 2012.

Profit Guarantee

There was no profit guarantee issued by Maybank and its subsidiary companies during the financial year ended 31 December 2012.

Material Contracts

There were no material contracts entered into by the Company and its subsidiaries involving Directors and substantial shareholders, either still subsisting at the end of the financial year ended 31 December 2012 or entered into since the end of the previous financial year.

Valuation Policy

The Company does not re-value its landed properties classified as Property and Equipment. The revaluation policy on landed properties classified as Investment Properties is disclosed in Note 2.3(xi) of the Financial Statements book of the Annual Report 2012.

Recurrent Related Party Transactions of a Revenue or Trading Nature (RRPT)

The Company did not seek any mandate from its shareholders nor enter into RRPT, which are necessary for its day-to-day operation on terms not more favourable to the related party than those generally available to the public and are not to the detriment of the minority shareholders for the financial year ended 31 December 2012.

This statement is made in accordance with a resolution of the Board dated 25 January 2013.

TAN SRI DATO' MEGAT ZAHARUDDIN MEGAT MOHD NOR

Chairman of the Board