Insurance Takaful

Etiqa Insurance and Takaful being one of the pillars of The House of Maybank aspires to be the undisputed leader in Malaysia and an emerging regional player in the insurance and takaful sector. Etiqa is determined to grow and become a solid pillar for the Maybank Group by contributing sizable revenue and higher profits.

"Etiqa is about people. Caring about people is vital for our business sustainability. We break down boundaries and we aim to change the face of the industry, to make life easier yet tangibly richer for everyone. We deliver best quality services and go the extra mile for our customers by doing it the Etiqa Way".

Hans De Cuyper

Head, Insurance & Takaful

Chief Executive Officer of Maybank Ageas Holdings Berhad

Highlights

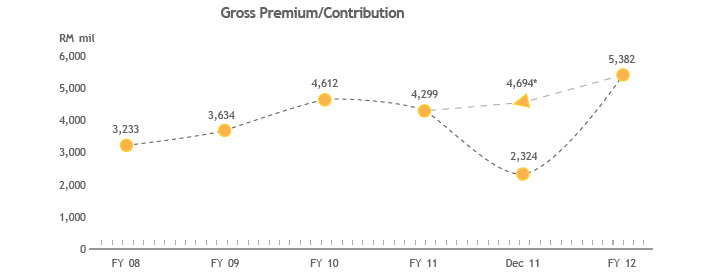

- For the financial year ended 31 December 2012, Etiqa's Gross Written Premium (GWP)exceeded RM5 billion.

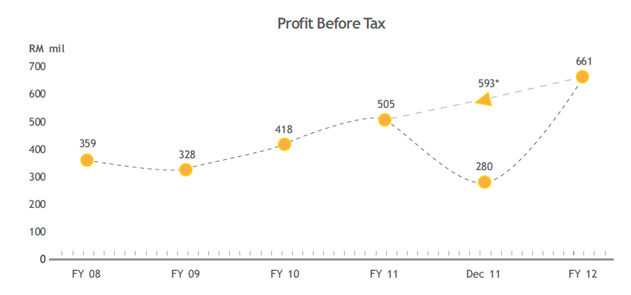

- Etiqa registered 11% growth in profit before tax, which soared to RM660.5 million.

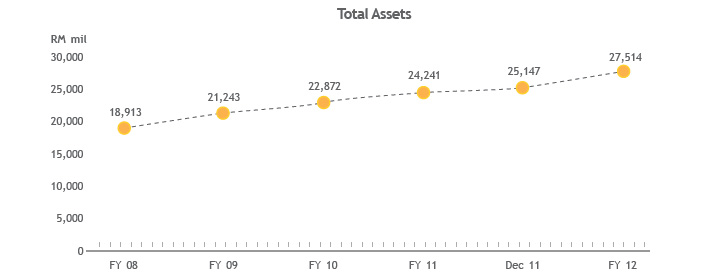

- Total assets grew 9.4% to RM27.5 billion from RM25.1 billion as at 31 December 2011.

- Combined gross premium and contribution recorded 15% growth year-on-year.

- Etiqa is currently No. 1 in combined New Business Life Insurance/Family Takaful and also in General Insurance/General Takaful.

- Etiqa has the largest agency force with more than 22,000 agents (both Life/Family and General).

- Our Bancassurance business is currently No. 1 with a 32.6% market share for conventional New Business (LIAM Statistics 12 months ended 30 September 2012)..

Overview

Etiqa offers a unique and personalised brand of services across all types and classes of life and general insurance, as well as family and general takaful plans through a multi-channel distribution network. Its wide range of life and family products include endowment, term, personal accident, education, investment-linked and medical insurance while the general conventional insurance and takaful range includes fire, motor, aviation, marine and engineering policies.

With customers' accessibility in mind, Etiqa features a strong agency force comprising over 22,000 agents and 33 branches throughout Malaysia, plus a wide Bancassurance and Bancatakaful distribution network with 401 Maybank branches and other third party banks. To cater for netizens, MotorTakaful and Maybank2U offer direct sales through the internet. Moreover, Etiqa's availability through cooperatives, brokers and institutions brings it closer to its customers and increases its reach in the Malaysian market.

Etiqa works hand-in-hand with its partners and customers to humanise insurance and takaful in line with Maybank's aspiration of humanising financial services across Asia. Etiqa's passion is backed by the strength, expertise and rock solid foundation of the nation's top financial institution and driven by the professionalism, empathy, courage and integrity of its employees.

Etiqa Insurance Berhad (EIB), the conventional insurance arm of Etiqa, is the only insurance company in Malaysia to achieve an ‘A' Insurer Financial Strength (IFS) rating by Fitch Ratings. This rating reflects EIB's strong business profile in the domestic life and general insurance market, its extensive distribution capacity, consistent operating performance, sound quality and prudent investment approach. The rating also acknowledges EIB's solid capital position on a risk-adjusted basis and sound reserving practices.

Etiqa has embarked on a three-year plan beginning 2012, to be the Undisputed Leader in Malaysia and emerging regional player in the insurance and takaful sector. With the completion of year one, the milestones achieved reflected a strong start for Etiqa's journey towards its aspirations.

Financial Performance

Combined gross premium and contribution surged 15% year-on-year (against the restated 12-month figure), attributed to solid growth of both Life Insurance/Family Takaful and General Insurance/Takaful businesses.

Note for *:

December 2011 restated 12-month

figure. (December 2011 figure of

RM2,324m is based on six months'

performance due to change in

Financial Year end from June to

December).

For the financial year ended 31 December 2012, Etiqa registered 11% growth in profit before tax (PBT) year-on-year, which soared to RM660.5 million as a result of improved surplus transfer from the Life Insurance/Family Takaful Fund, favourable investment performance of all funds and higher wakalah fee income. Total assets rose 9.4% to RM27.5 billion from RM25.1 billion in the previous year.

Note for*:

December 2011 restated 12-month

figure. (December 2011 figure of

RM280m is based on 6 months'

performance due to change in

Financial Year end from June

to December).

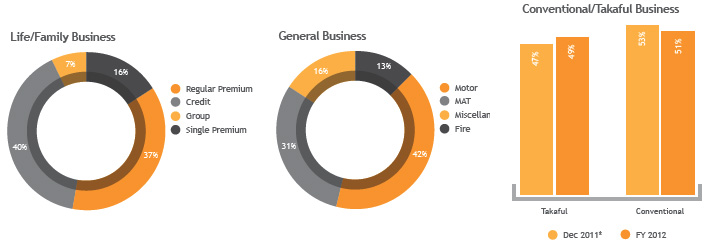

During the same period, Life/Family business grew 18% year-on-year, driven mainly by Single Premium investment-linked from Maybank Bancassurance channel and Credit business from Third Party Bancassurance channel. For General Insurance/Takaful, the growth in all classes of business, especially Motor, resulted in General business rising 10% from the previous year.

The contribution of business from the various segments is depicted below:

Overall, takaful continued its positive momentum, increasing 19% year-onyear over the previous year. The gross contribution surpassed RM2.6 billion, contributing 49% of Etiqa's total gross premium/contribution.

Our General Takaful business continued to outperform market growth, commanding a 49.4% market share, whilst the Family Takaful new business market share came down slightly to 35.6% (Insurance Services Malaysia Berhad statistics 12 months ended 30 September 2012).

Product Inovation

Etiqa delivered its promise to be the product supplier of choice for its distribution partners in areas like retirement savings, education planning and wealth protection.

2012 also saw Etiqa launching a myriad of products including:

- Golden Retirement is a close-ended, single premium investment-linked plan that offers ten years of guaranteed minimum cash payments of 11% p.a. of the single premium. The cash payments are payable from the end of sixth to fifteenth policy year. This product also provides a potential lock-in amount based on the Active Index Portfolio. The additional payments, if any, will be paid out together with the yearly cash payments and at maturity of the policy.

- Dragon9 is a three-year nine-month single premium, closed-ended, investment-linked plan with capital guaranteed payable at maturity of the policy. It offers a guaranteed cash payout of 5.75% of the single premium at the end of the eighteenth policy month.

- Ultra Medic Rider is a yearly renewable hospital and surgical medical plan that provides comprehensive medical coverage of up to RM1,500,000 with a choice of five different plans. Some unique features of the plan are Medical Second Opinion, Alternative Medicine Treatment, No Claim Bonus and No Co-Takaful/Co-insurance. The riders are available for both life and family takaful plans.

- Aspire is a participating endowment plan that matures at age 21. It is a child's education plan that provides guaranteed cash payouts of 30%, 30% and 40% of the Sum Insured payable at the end of the last three policy years prior to maturity. It also provides a guaranteed maturity benefit of 50% of basic Sum Insured. The plan offers an Academic Excellence Award as an incentive to reward academic achievement for major examinations in Malaysia.

Agency Transformation

The Agency Transformation Plan, also in its first year of inception, saw the laying of the right foundation to build a strong culture for sustainable business growth. The Life and Family Agency force has been instilled with a greater performance culture with the right tools to increase persistency and collection efficiency. This is further solidified with the new agency compensation plan which will be implemented in 2013 which aims to reward high achievers

People

Every great organisation recognises its people and their talents. Etiqa encourages an innovative culture by introducing several platforms to inculcate innovation, for example the Young Executive Townhall and Staff Time Out Sessions. These platforms, hosted by the Etiqa Senior Management Committee, bring down the barriers between different levels of staff and foster better relations among Etiqans.

Living Up To Our Promises

In a highly regulated industry, Etiqa strives to simplify processes for the convenience of its customers. The following are some key proof points which Etiqa introduced during the year:

- A hassle-free process for claims below RM2,000 for Home Protection and Personal Accident plans

- The convenience of a medical check-up anywhere for Life or Family plans

- The ability to check claims online anytime for Motor and Retail Fire plans

- Updates through short messaging service (SMS) on the status of claims

International Presence

Etiqa has established operations in Singapore, Brunei and Pakistan. In addition to supporting Maybank's aspiration to be the top regional player, international expansion will provide Etiqa with an attractive opportunity to acquire a significant presence in high growth markets, through Maybank's overseas operations and Etiqa's expertise in takaful and bancassurance.

Etiqa Insurance Berhad (EIB) Singapore

Etiqa's Singapore branch turned around in FY2012 with a PBT of SGD6 million, compared to a Loss Before Tax of SGD9 million in the same period last year. This was attributed to improved revenue surplus and investment income. It also recorded a slight increase in revenue of SGD38 million. Through rigid and disciplined underwriting, the motor premium contribution was reduced from 33% to 30% of GWP. There was also increased business in the Miscellaneous segment (from 44% to 45%) and Fire segment (from 19% to 21%) whilst Marine, Aviation and Transit segment remained at 4%. The overall distribution channel mix improved with Bancassurance as the main contributor with 26% of sales. Looking ahead, the branch is aiming to capture new market segments by enhancing the product offering to broaden its market base while retaining its profitability.

Etiqa Insurance Berhad (EIB) Brunei

Etiqa's Brunei branch posted a healthy 12% growth in GWP from last year. Etiqa Brunei general insurance business is dominated by the Agency channel as the main revenue contributor (92%), with a concentration mostly on corporate and project risk. The branch aspires to strengthen its portfolio and carve niches in non-motor business besides riding on upside potential of the country.

Pak-Kuwait Takaful Company Limited (PKTCL) Pakistan

Through a 32.5% shareholding in PKTCL, Etiqa Overseas Investment Private Limited (EOIPL) is the single largest investor in Pakistan's first takaful company. Despite the many challenges faced in 2012, the company grew 21% in gross written premium compared to last year.

Operational Excellence

In line with the aspiration to create a mobile workforce, Etiqa introduced Straight-Through-Processing (STP) using an Enterprise Portal Solution (EPS) platform for Agents of Life/ Family business.

This multi-phase project reengineered the current Agents' submission process into online submission with full capitalisation of technology enablement. It also integrated tools such as laptop and biometric devices to compliment the process.

Enhancing Customer Experience

As part of Etiqa's brand promise, we have adopted a strategy to humanise all customer interactions. Acknowledging that the first encounter with our customers must give that impression, we took a bold step to abolish the automated voice response. Our customers were pleasantly surprised by the personal touch and convenience.

During the year, Etiqa Oneline handled more than one million servicing calls from Etiqa's policyholders and business partners. We registered a high contact resolution rate of 95.5%, resulting from an improved level of team competencies in terms of technical and behavioural skills.

We received due recognition from the industry in the form of awards from the Customer Relationship Management & Contact Center Association of Malaysia.

Highlights:

- 2nd place in the Contact Centre Association Award for the Best in-house call centre under 100 seats in 2012.

- 2nd place in the Contact Centre Association Award for the Best Corporate Video

- 3rd place in the Contact Centre Association Award for the Best Technology Innovation

- 3rd place in the Contact Centre Association Award for the Best Process Excellence

Awards

During the year Etiqa garnered the following awards:

- Most Outstanding Takaful Company, Kuala Lumpur Islamic Finance Forum (KLIFF), 2012

- Best in the Family Takaful (Group Business Operator), Malaysian Takaful Association, 2012

- Best Takaful Company (Asia), International Takaful Summit, London, 2012

- Best Bancatakaful (Asia), International Takaful Summit, London, 2012

- Best Marketing (Asia), International Takaful Summit, London, 2012

- Best Takaful Institution, The Asset Triple-A Islamic Finance Awards 2012

- Best Takaful Company, Global Islamic Finance Awards 2012

- Best Malaysia Service to Care in Insurance, Malaysia Service to Care Awards, 2012

- Best In-house In-bound Contact Center (under 100 seats) – Silver, Customer Relationship Management & Contact Centre (CCAM) Industry Awards 2012

- Best Process Excellence Contact Center (open) – Bronze, Customer Relationship Management & Contact Centre (CCAM) Industry Awards 2012

- Best Technology Innovation Contact Center (open) – Bronze, Customer Relationship Management & Contact Centre (CCAM) Industry Awards 2012

- Best Video for Contact Center (open) – Silver, Customer Relationship Management & Contact Centre (CCAM) Industry Awards 2012

- Best Contact Center Manager (under 100 seats) - Bronze won by Noordalina Daut, Customer Relationship Management & Contact Centre (CCAM) Industry Awards 2012

Corporate Zakat/Social Responsibility

Corporate Zakat Responsibility

The Corporate Zakat Responsibility Programme or CZR Programme by Etiqa is run as part of its commitment to provide zakat contribution to religious institutions as well as underprivileged groups around Malaysia. During the year, amongst Etiqa's contribution included:

- RM280,000 to build a shop house and office for Pondok Darussalam, Kuala Ibai, Terengganu.

- RM340,000 to build a new classroom building for Madrasah Al-Aminiah, Permatang Nibong, Pulau Pinang.

- Persatuan Kebajikan Islam Peribadi Mulia which received a new van worth RM150,000 from Etiqa Takaful.

Corporate Social Responsibility

-

Rumah Orang Asli

In December 2012, more than 50 members of Etiqa's Senior Leadership Team supported an Orang Asli village to help make their living experience better. This programme was to enhance the humanising experience that Etiqa has been living up to. -

Etiqa Nurtures: Adventure in Art and Creativity

More than 30 children aged 9-12 took part in this programme to visit the newly re-opened and refurbished Textile Museum in Kuala Lumpur.

Market Outlook

Malaysia's insurance and takaful sector may see its earnings stability challenged by regulatory initiatives and ongoing capital market volatility. The sector will however continue to be underpinned by steady market growth and sound capital management. The regulator's intention to eliminate both the life insurers' cap on acquisition costs and the fire tariff pricing structure could undermine the stability of insurers' operating margin. The impending implementation of the Personal Data Protection Act could also modify insurers' business practices, potentially leading to higher compliance costs.

The takaful segment is expected to continue registering high double-digit growth of around 20% through 2014. Insurers have increasingly identified takaful as a high-growth, profitable segment.

The penetration rate of around 13% for family takaful (measured by number of life policies over population) is an indication of the latent potential for takaful versus conventional life insurance's 55%.

That said, the takaful industry is still at an early stage of development with growth expected to outpace the growth of conventional insurance, supported by the following:

- increased awareness, with the potential to diversify takaful from being a niche segment catering to Muslim communities

- enhanced regulatory reforms to support takaful infrastructure

- common ground and workable solutions for issues faced by Shariah committees and industry leaders

- stronger participation and liquidity in sukuks and Shariahcompliant instruments to support investment income

- strengthened takaful and re-takaful capacity

The announcement by Bank Negara Malaysia that it will introduce a risk-based capital framework for the takaful sector in 2014 will align the capital requirement of takaful operators with that of conventional insurers. This also means capitalisation will more accurately reflect takaful operators' risk exposure.

Capitalisation of conventional insurers will remain healthy as the industry-wide consolidated capital ratio in 2012 was still well above the 130% regulatory minimum. Negative rating triggers for the life and non-life insurance sectors include extreme equity market volatility and interest rate movements. The widening of deficits from motor insurance third-party bodily injury and death could also affect the outlook on the non-life sector. Nonetheless it could be revised to positive if insurers are able to consistently improve their overall underwriting margin after the liberalisation of compulsory motor pricing.